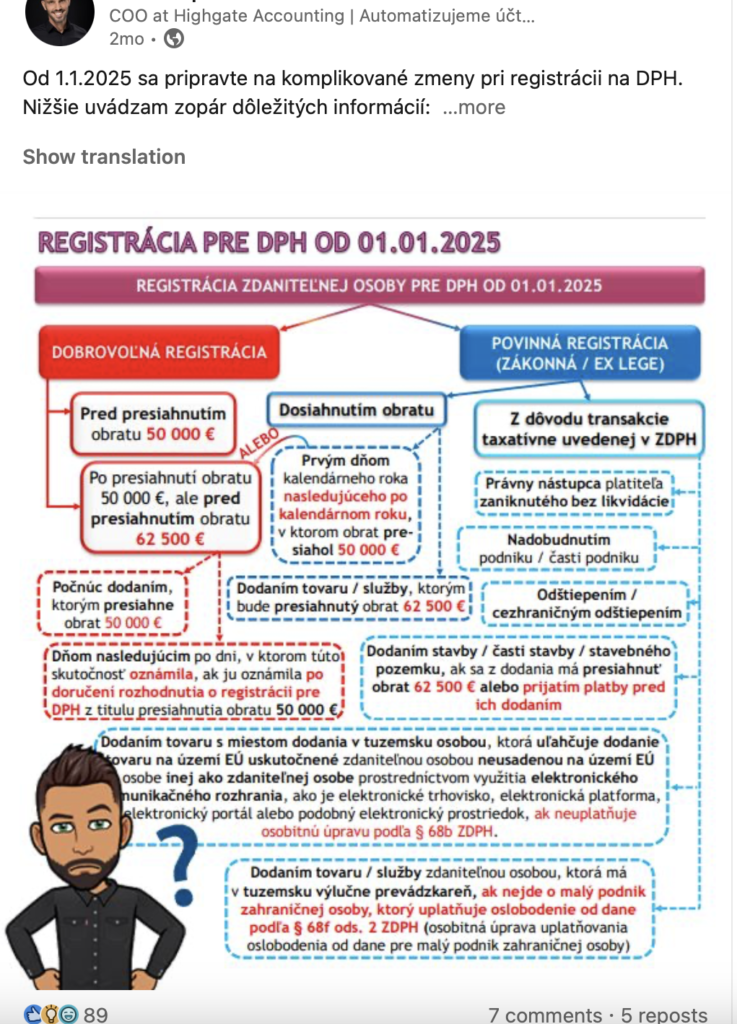

From 1.1.2025 get ready for complicated changes when registering for VAT. ➡Voluntary registration – before exceeding 50,000 turnover – pretty easy and understandable

➡After exceeding 50,000 turnover but before exceeding 62,500 turnover – here you go 3️⃣ options: 1️⃣ Notify the Tax Office that you have exceeded 50,000 turnover and the Tax Office will automatically register you as a VAT payer within 21 days from 1 January of the following year 2️⃣ Or you can directly declare in the registration form and become a payer starting with the supply where you exceeded 50,000 turnover (i.e. you will charge VAT on the supply). 3️⃣ Or you notify the Tax Office that you have exceeded 50,000 turnover and the Tax Office automatically registers you as a VAT payer within 21 days from 1 January of the following year. When you receive the registration decision, you tell yourself that you still want to be VAT registered in that year. You notify the tax office of this fact and the day after this notification you become a VAT payer ➡Let’s combine further, in point 1. if the decision to register as a VAT payer from 1.1. arrives and you exceed the turnover of 62 with further supplies within the calendar year.500, you have to submit a new application for registration and you become a VAT payer starting from the supply which exceeded the turnover of 62.500, thus you become a VAT payer earlier than stated in the original decision ➡In point 3. For example, it may happen that although you have exceeded the turnover of 50.000, but you have not yet received the decision on VAT registration and at the same time you have already exceeded the turnover of 62.500, so you file a new registration stating that you have exceeded the turnover of 62.500 and at the same time you must already charge this supply of goods/services to VAT (even if you have not yet been assigned a VAT ID number) ➡LinkedIn has limited me to “freedom of speech and characters”, so I do not give any more examples here. I am still hopeful 🙏, that the advent of legislative news will simplify our profession and we can concentrate on quality advice and work as accountants. I am not going to cry over spilt milk. We need to embrace this and set up our internal processes so that it ‘hurts’ as little as possible. For us it will look something like this:

✅We will encourage our clients, if they are planning to become VAT payers, to think about it at the outset and proceed to voluntary registration

✅We will charge non-taxpaying businesses where there is a risk of exceeding turnover on a monthly basis

✅We will warn the directors of non-paying companies that they must watch their turnover and invoice continuously, not on a rolling basis. If they are aware that they are close to exceeding the 50,000 threshold, they must inform us immediately ❓Is there anything else absurd that surprised you about the VAT amendment? Thank you Martin Tužinský for the exhaustive 5 hour training😮💨. It’s so complicated we could go on for hours.

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk