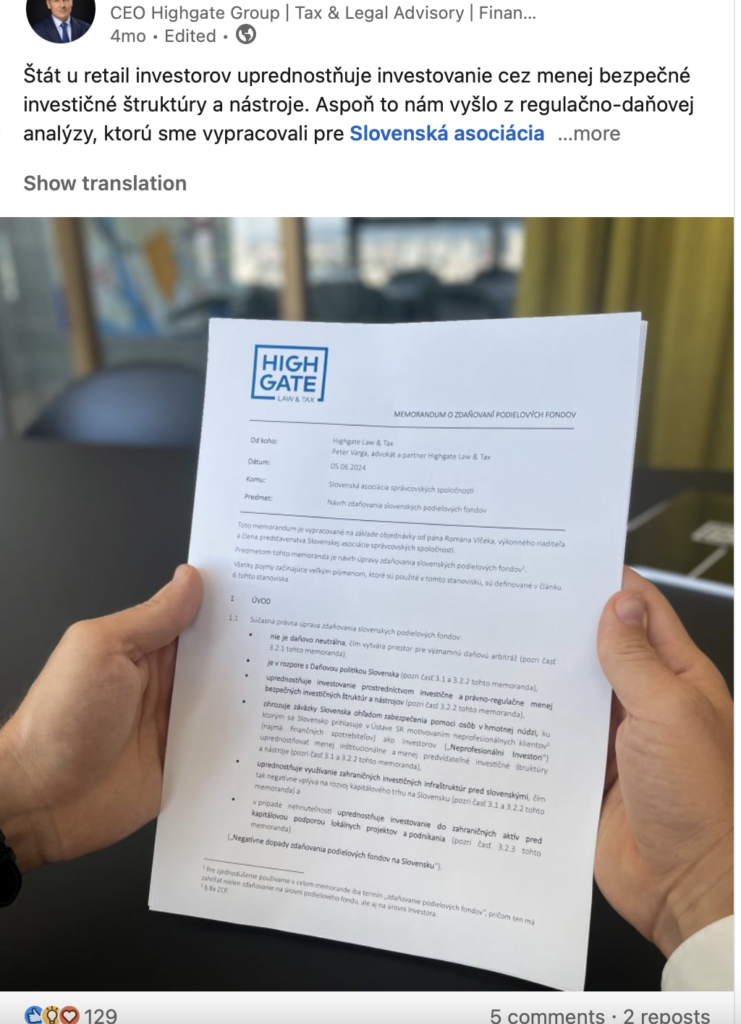

The State’s preference among retail investors is to invest through less secure investment structures and instruments. At least this is what we found out from the regulatory and tax analysis we prepared for the Slovak Association of Asset Management Companies. We compared the tax and regulatory regimes of various investment vehicles with SK mutual funds. For real estate funds, for example (simplified): ➡️ investing in SK real estate through a SK mutual fund = 2 taxes (i.e. local corporate tax of 21% and redemption tax of 19%);

➡️ investing in SK real estate directly = 0 or 1 taxation (see my podcast on real estate taxation https://lnkd.in/eNGCMf39);

➡️ investing in SK real estate through a bond structure = 1 taxation (i.e. local corporate tax of 21% or withholding tax of 19%).

or

➡️ investing in US ETFs via a SK mutual fund = 3 taxes (i.e. local corporate tax, 30% dividend tax and 19% redemption tax);

➡️ Investing in a US ETF directly = 1 tax by default (i.e. local corporate tax). And in the context of regulation, for example, you can set up a bond issue on domestic/foreign real estate for retail relatively flexibly and cheaply without any interference from the NBK. In contrast, a mutual fund for retail is a majesty for min. tens of thousands of EUR. This legislative situation motivates retail investors to choose more tax-efficient solutions and investment solution vendors to provide less institutional solutions. However, both generally have a common denominator, which is higher risk. This is in confrontation with Slovakia’s obligations under the Slovak Constitution and it fully exposes the long-standing unsystematic nature of legislative changes in Slovakia (see reasons in the figure). In the analysis, we also propose solutions to achieve at least some kind of tax neutrality, namely (simplified): ➡️ tax mutual funds at 5% (today they are 0%),

➡️ not taxing qualified redemptions for certain types of funds (today it is a flat 19%); and

➡️ tax returns on certain types of funds at 10% (today it is 19%). So we’ll see how the discussion with MinFin develops. Anyway, thank you for your trust Marek Prokopec, CFA from Tatra Asset Management and Roman Vlcek. And thanks to Petr Kotab of Dentons for his help in producing the analysis. Otherwise, I talked about how regulation makes sense for a retail investor when investing in real estate funds in a short video podcast with Tomas Car from 365.invest (link in the commentary).

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk