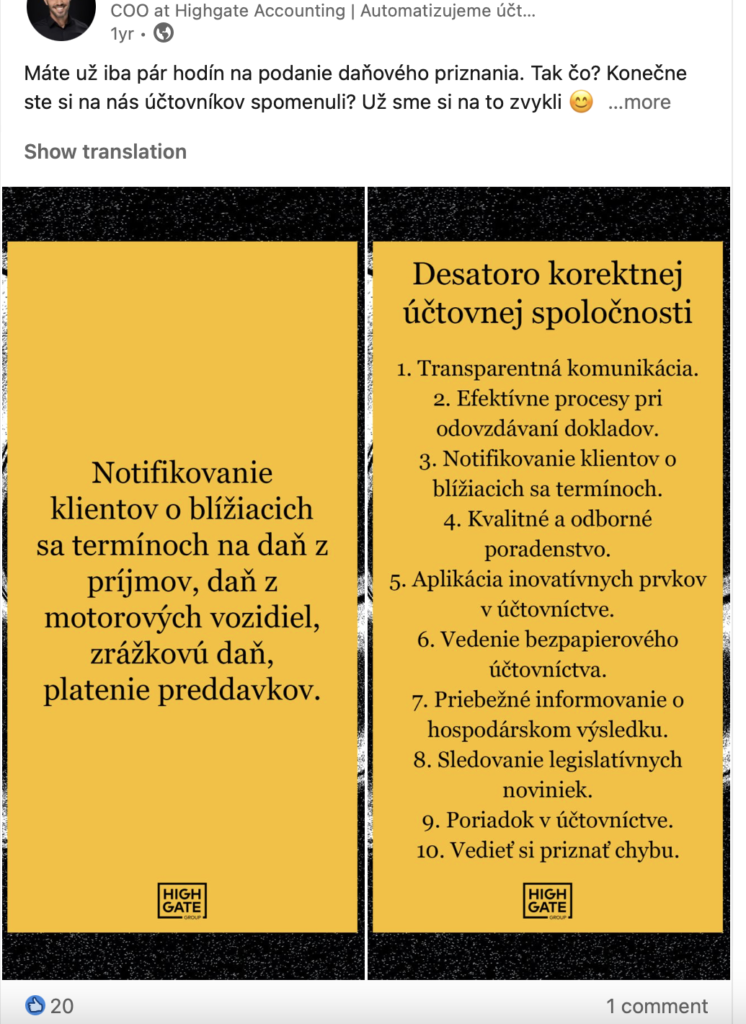

You only have a few hours to file your tax return. So what? Have you finally remembered us accountants? We’ve got the hang of it 😊 Anyone can forget, so it’s good to have someone to remind you of important deadlines. There is no notification like a notification. Ours is not meant to be annoying but helpful. For example, on New Year’s Eve you are in the Christmas mood, relaxing. After the holidays it is harder to get in shape and therefore you may miss some deadlines. No, it’s not just January and the end of March, it’s the whole year where the client has a number of deadlines to meet with various institutions. So how can an accountant be of assistance? He should notify the client regarding these most important deadlines: ➡️ Submission of documents – approaching deadline for VAT/QA/QS/OSS processing

➡️ Withholding tax (by the 15th day) – dividends paid, royalties paid to an artist (work, performance, licence)

➡️ January tax on motor vehicles

➡️ January withholding tax notice (for artists)

➡️ Approaching filing date – Income tax for POs and FOs

➡️ Payment of advances

➡️ Approaching Filing Date – Property Tax How can the client be of assistance in meeting these deadlines? ✅ Continuously upload/submit documents to the accountant during the current month

✅ Notify the accountant when a dividend or artist fee is paid

✅ When purchasing a car, deliver a large TP to the accountant

✅ Set up a standing order with your bank to pay advances Did you receive such a notification during March? 😉 “Dear Client,

This is to inform you regarding the upcoming deadline (31.03.2023) for filing personal/corporate tax returns…”

Peter Šopinec

Highgate Accounting

If you want to know about a predictable and fair approach in accounting watch my mini-series “The Ten Commandments” and click 🔔 on my profile.

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk