UNPAID LIABILITIES AFTER 100 DAYS AND DPH REFUND. WILL SOME ACCOUNTANTS QUIT (BUT NOT BECAUSE OF AUTOMATION)? The novelty (amendment effective from 2023) is based on a long-standing EU requirement (simplified): if a company fails to pay an invoice, it must reimburse the VAT deduction claimed (“Customer”). If companies fail to pay an invoice, they can claim a refund of the VAT paid (“Supplier”). Reasonable and clear. The amendment thus seeks to grasp this principle in a prescriptive way: if the Customer has outstanding debts with a payment period of more than 100 days, it must repay the VAT deduction. Exceptions? ✔️ 100 days have not elapsed, but circumstances under section 25a(2)(b), (c) or (g) (until 2022) (f) (from 2023) have arisen;

✔️ 100 days have elapsed but the customer has not yet claimed the deduction;

✔️ 100 days have elapsed and the customer is in the process of deducting VAT;

✔️ 100 days have elapsed before 2023 and the claim has become uncollectible by the Supplier under section 25a(2)(a) or (f) of the Act in force until 31.12.2022;

✔️ 100 days have elapsed before 2023 and the claim has become uncollectible by the Supplier pursuant to section 25a(1)(a) of the VAT Act.

2 lit. (b) or (c) or (g) (until 2022)/(f) (from 2023);

✔️ 100 days have elapsed before 31.12.2022 and the claim has become uncollectible by the Supplier under section 25a (2) (a); If the Customer reclaims the VAT and then pays the liability, the Customer can claim a refund of VAT but only in 2 of these 3 regimes in the tax year of payment or accrual of the right: ✔️ Within 150 days of the due date;

✔️ After 150 days from the due date, but only if the Customer has evidence that the Supplier has not proceeded to claim VAT on the irrecoverable debt;

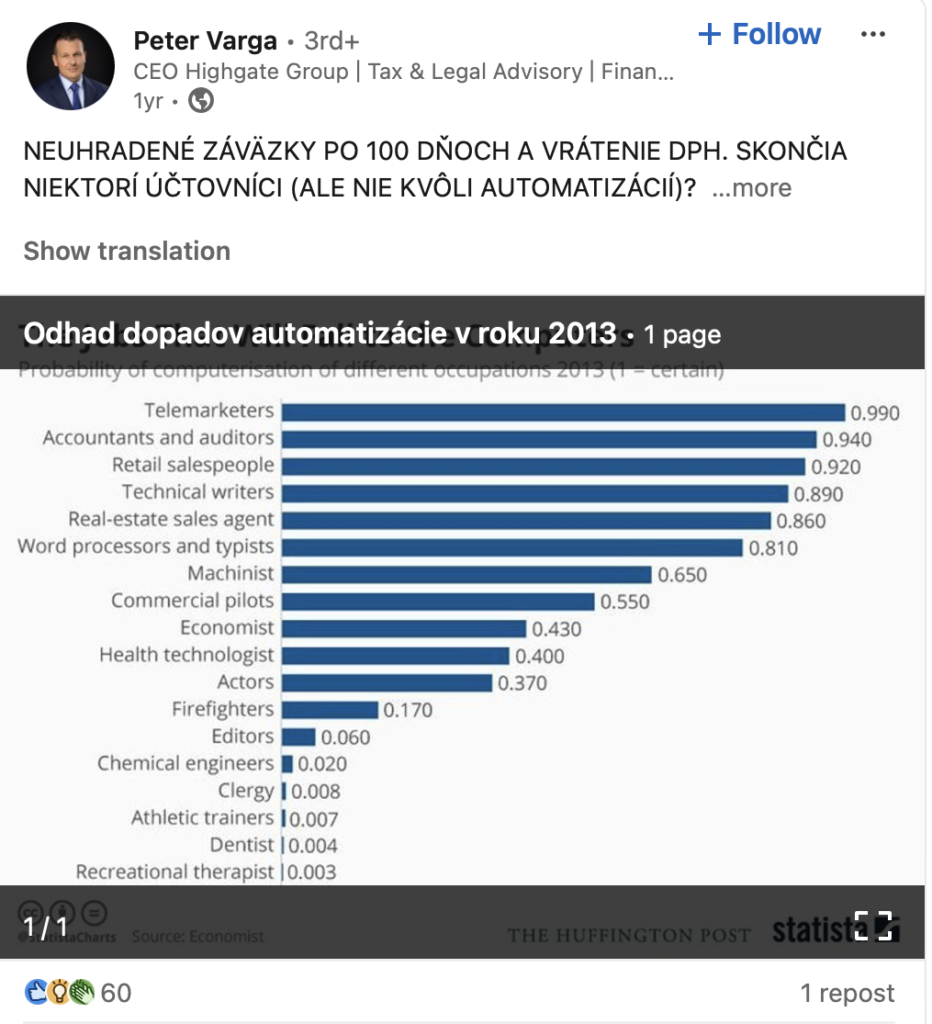

✔️ After 150 days from the due date, but upon receipt of a correcting document from the Supplier; Similar complexity from the Supplier’s perspective. And watch out for the implications for coefficients or adjustments to the VAT deduction 😊 ➡️ Could it have been written more simply? I don’t know… and I don’t want to be elementary in my statements But the drafter of tax laws has a relatively clear space when drafting them by the Constitutional Court (Constitutional Court 5/2012). It must not impose an unreasonable burden on business that is manifestly disproportionate to the public interest being served. And it should be concise (Law 400/2015). There are more such principles and they can be used in litigation or in criticism of certain tax institutes (for example, my criticism of the CFC rules). ➡️ Would it be advisable to make it simpler? Certainly yes How accounting firms can incorporate this knowledgeably and procedurally (especially smaller ones) and cost-effectively (especially larger ones) time will tell 🤔. And some may wrap it up because it is also a liability. If it was claimed 10 years ago that by 2023 most accounting work would be gone, it was a bad guess. Robotization may be advancing (after all, my colleague Peter Šopinec is still writing and lecturing about it, and we are continuously implementing it with clients), but (i) the floridness of economic relationships (just the kind of fund accounting and taxation or cryptos that we are constantly creatively addressing is a case in point) and (ii) legislation is stronger. P.S. The Income Tax Act had 32,000 words in 2003 after tax reform. Today 104 000 😊 (to be fair – partly for legitimate reasons)

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk