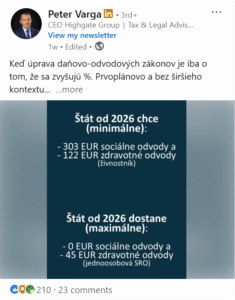

When adjusting the tax laws is only about increasing the %. Primarily and without wider context…

When we argued the Laffer curve in the parliament in December 2023 together with Davy Cajko, Juraj Forgacs, Daniel Gaspar or Peter Cmorej, the answer was an estimate of the Ministry of Finance that the taxation of the crypt should bring up to 11,508,000 EUR in 2024…

In 2023, the state’s income from the “crypt” amounted to €560,000 and (only) 822 people declared income… For 2024 we will see…

By the way, the taxation of gains from the sale of cryptoassets (even tokenized securities) is to be “lim →35 + 16” or “lim →35 + 33 (with cap)” for traders from 2026. How many Slovak BTC millionaires will pay such a tax?

And raising taxes/taxes on employees? I assume that our legal/tax advice on setting up various hybrids will no longer be a complete taboo for corporations.

And maybe not even for Social Security – as part of the consolidation on that spending side 🙂

But I wanted something else. On November 18 we are holding a conference not only on the above, but also on these topics below:

– How to protect corporate and personal assets from state interference, execution or bankruptcy.

– Risks for statutory officers: “I close a company and open a new one”, “white horse” and the practice of the police and prosecutors.

– Advantages and disadvantages of moving to the Czech Republic, Austria or the UAE.

– Trusts, foundations and holding structures as a tool for asset protection.

– Tax optimization options for foreign structures – where are the limits

– Why it may make sense to stay (at least partly) in Slovakia and what investment decisions make sense here today

– If Slovakia is demographically dying out, does it make sense to buy an investment apartment in Slovakia or invest in other assets in Slovakia.

More info here: https://lnkd.in/eCcwFZzB

Come. There will certainly be room for fruitful discussion.

Highgate Law & Tax

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk