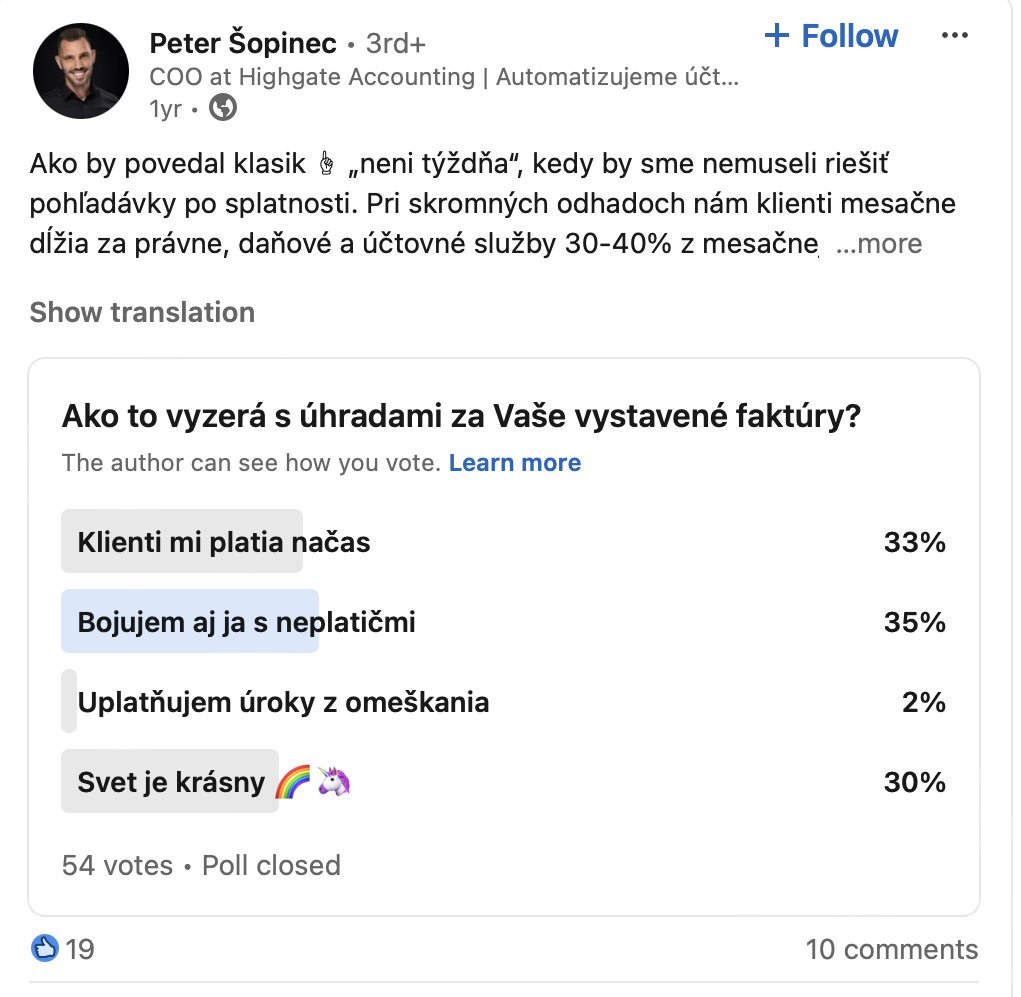

As the classic ☝ would say, “there is not a week goes by” when we don’t have to deal with overdue debts. At a conservative estimate, clients owe us 30-40% of their monthly billing for legal, tax and accounting services. We’re talking tens of thousands… And that’s how the annoying paperwork starts for us: 1️⃣ . I send an invoice and wait to see if the client pays the invoice when it is due (15 days).

2️⃣. As the due date approaches, I remind the client of the invoice (I do this by feel and differently for each one – depending on the client’s sensitivity).

3️⃣ The invoice is a day overdue. I send him a reminder.

4️⃣ The invoice is a week overdue. I send him another reminder.

5️⃣. The invoice is two weeks overdue. I’m calling.

6️⃣. The invoice is over a month overdue. The managing director is calling. We have automated some of these tasks, but an automated machine will never give you an assessment of the relationship with the client and the client’s sensitivity. Debt collection will eat up your precious time that you could have been devoting to growing your business. The frustrating part is that you did the work and your salary is hanging in the air somewhere 💸. That’s why we are realistically considering starting to apply default interest to clients. Late payment interest is legal, automatic and does not need to be negotiated. For us, they should mainly serve three purposes: ✅ They compensate for the time burned by debt collection. ✅ They improve internal cash flow. ✅ Train clients to pay on time. Let’s be friends, but let’s pay our debts 🤝

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk