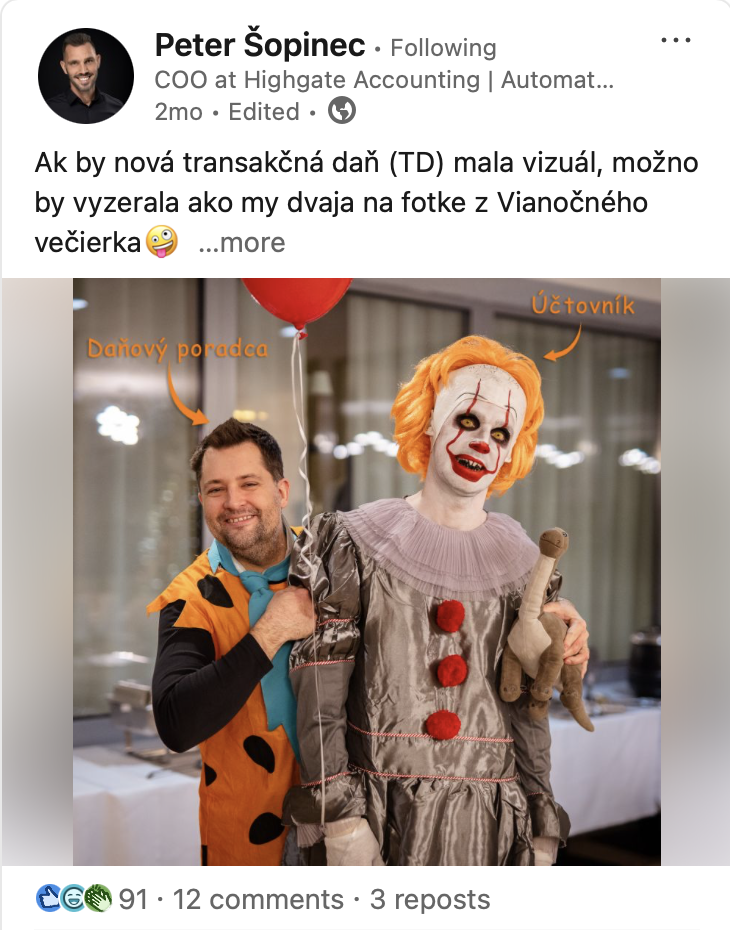

The financial transaction tax reminds me of the circus 🤡 and a throwback to the days when Fred Flinstone lived 🦕.

1.4. is knocking at our door, and the more we dig into the subject, the more we come up with all sorts of absurd scenarios.

With Martin Tužinský we simulated corporate payments and issued

and a receipt with the TD application📝:

➡️ A client mistakenly pays you €5,000 for accounting services from another firm, asks you to reimburse him for paying it from the correct firm (TD: €2️0)

➡️ You pay 4 new employees an advance payment of €250/total €1000 for meals (TD: €4)

➡️ The client is not satisfied with the delivered service and you decide to credit part of the service in the amount of 1000 € (TD: 4 €)

➡️ You mistakenly pay VAT of €15,000 from an account that you have not declared as a transaction account (TD: €40)

➡️ You go to pay employees their net wages of €18,000 (TD: €72)

➡️ You have €0 in a declared transaction account, you need to transfer €50,000 from your current account to it for advance payments (TD: €40)

➡️ You pay yourself a monthly licence fee of €2,000 (TD: €8)

➡️ Your company has bloodily made some money and you go to pay yourself a profit of €15,000. In addition to the 7% withholding tax, you will also have to pay transaction tax (TD: €40)

➡️ You receive a deposit of €7,000 for a contract that ultimately fails to materialise and you have to return it (TD: €28)

➡️ You buy a car on credit, where you pay 2x €10,000 down payment and then pay the extra €20,000 (TD: €120)

➡️ Employees use a Multisport card, which is topped up monthly for €500 (TD: €2)

➡️ You go to pay monthly payments to suppliers/contractors, of which there are 40, and each sends you an invoice for €2,000 (TD: €320)

➡️ Even the bank account maintenance fee of €19 did not avoid TD (TD: €0.08)

➡️ You make a contribution of €20,000 (TD: €40) to the ZI of a subsidiary

💰TOTAL: € 738,08💰

If you are a medium-sized company (20 employees and 20 contractors), the state will issue such a receipt.

Somewhere in the back of our minds, we hope our legislators will change their minds.

And if not, Martin Tužinský has a nice online/residential training on this topic tomorrow 7.2.25 – Financial Transaction Tax and its application in practice.

👉Link in comment👈

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk