Since we have a lot of experience with real projects in the field of blockchain and virtual currencies, our partner Peter Varga gave an interview about the legal and tax regulation of this phenomenon in recent years, this time for the weekly Trend. In connection with crypto and blockchain, we have advised on legal, tax […]

V Highgate Group we strive to continually improve and modernise the content and form of our services, which includes tax and legal advice for our clients. Since we have IT companies among our clients, we decided to organize a conference on 24.4.2019 at the Falkensteiner Hotel in Bratislava on the topic tax optimization for Slovak […]

Given that as Highgate Group we have a very rich experience in legal, tax and accounting grasp of the quite broad ecosystem around blockchain, we participate in several events dedicated to blockchain. This was also what the recent Impact Hub conference Impact of Blockchain vol.2: Fundraising was all about, which Peter Varga participated in. Peter […]

In December 2018, the Ministry of Finance of the Slovak Republic issued an amendment to the guidelines on the determination of the content of documentation pursuant to Art. 1 of Act No. 595/2003 Coll. on income tax. The new guidance has the number MF/019153/2018-724 (“the new guidance”) and is published in the Financial Bulletin 2018 […]

For transfer pricing purposes, one of the most important things is to define entities/companies based on their characterisation. Entities can be categorised according to the activity they carry out and within that activity, what functions they have and what risks they bear. The number of functions and the amount of risk of an entity is […]

The Ministry of Finance of the Slovak Republic has decided to unify the scope of full documentation with the scope required and set by the OECD Transfer Pricing Directive . This step has significantly increased the scope of required data in the general group documentation (master file), but also in the specific documentation (local file). […]

Are you an IT entrepreneur interested in the issue of tax optimization? Do you work as a digital nomad or are you more attracted to an office in Singapore? On 24.4 we are organizing a conference on Tax optimization in IT companies, where we will deal with the issues of how to tax income from […]

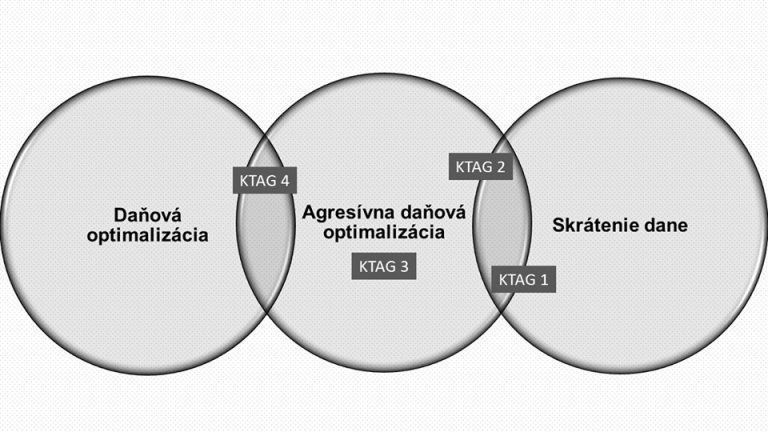

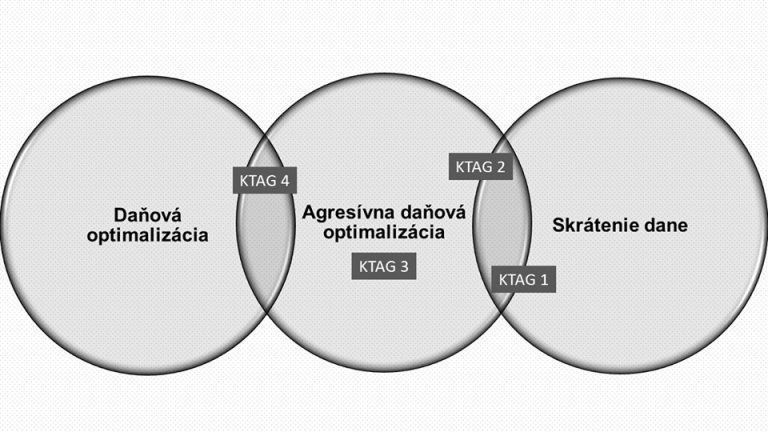

Peter Varga, our partner and tax lawyer, gave an interview to TREND in which he commented on the case of KTAG and Andrej Kiska from the perspective of tax and tax optimization. It was during tax optimization there are situations that cannot be assessed in a completely black and white way, such as the case […]

Answers from Peter Varga on the topic of paying taxes, or the legal defectiveness of platforms called. The sharing economy can be found in several articles in Hospodárske noviny during this period. We bring you part of the interview with our managing director in this article. How does Slovak law regulate the sharing economy? Which […]