Our partner Peter Varga, an expert in tax law, was a speaker at Reality Expo 2025, where he presented proven and legal strategies on how Slovak investors can effectively invest in foreign real estate – for example in Dubai, Spain or Greece, but also in other attractive areas.

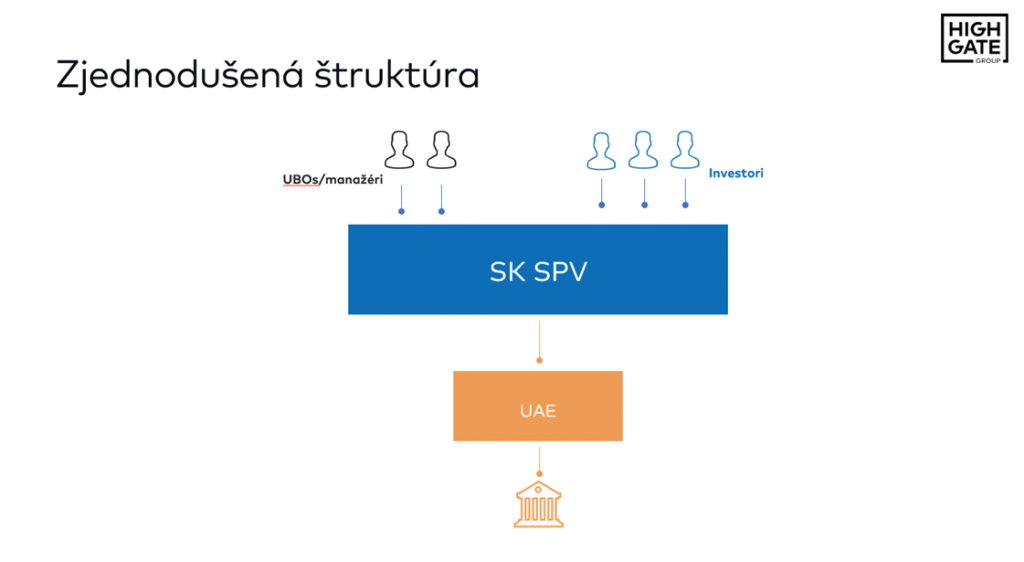

During his presentation he presented the most used structure with the Slovak SPV (Special Purpose Vehicle) as the basic central element of the investment structure. It allows flexible capital entry through a holding company, crowdfunding, bond issue, fund or joint-venture cooperation and subsequently provides equity or debt entry into a foreign project with optimal tax and levy settings. He has also dealt with the taxation of rental income and the sale of real estate abroad – an area where many investors lose money unnecessarily simply because they do not have the right structure in place.

An investment in a rental apartment, holiday home or commercial project abroad can be highly profitable – but only if it is set up correctly legally and tax-wise.

We will be happy to design and build you a stable, transparent and tax-efficient structure that protects your capital, minimises risks and ensures you pay taxes where it is most beneficial and legal for you.

We have been actively involved in real estate investing, whether in the Slovak Republic or abroad, for a long time and you can find useful outputs on the following links:

If you are interested in this topic, please do not hesitate to contact us:

Peter Varga, e-mail: peter.varga@highgate.sk

For more on tax and real estate, see this section of our website: real estate and legal and tax structures.

If you are interested, you can also subscribe to our newsletter for interesting practical legal and tax information free of charge: Subscribe to the newsletter.

Alternatively, you can address your specific questions in a consultation with our partner Peter Varga, who specialises in financial regulation and tax law. You can book a consultation here:

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk