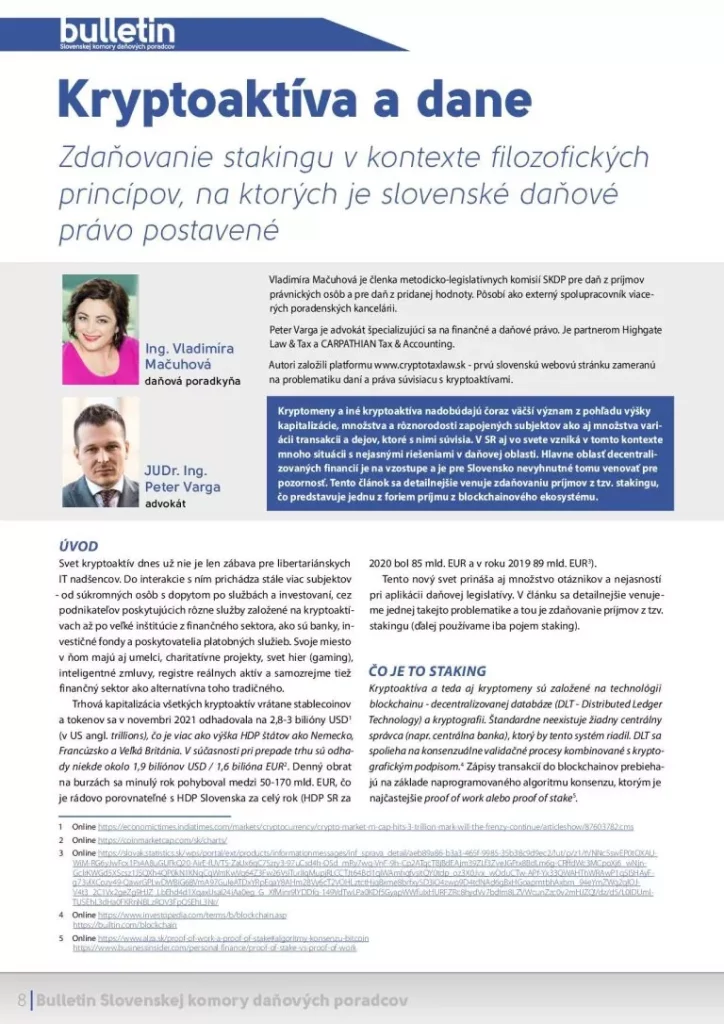

V Bulletin of the Slovak Chamber of Tax Advisors we published an expert article on the topic of staking taxation in Slovakia. The article is followed by a legislative proposal, which we have submitted to the relevant people for the state to deal with. It is the first legislative initiative of our crypto platform Crypto Tax & Law.

Our primary objective is that the income from staking should be taxed only at the moment of disposal of the crypto asset in question. However, if we do not take this view legislatively, in a few years’ time at tax time, the state may want to tax staking rewards at the moment of receipt. You can read the article below.

In the crypt area we deal with various projects on the legal, tax and accounting side. In addition to the standard tax and legal advice in connection with the taxation of crypt profits (and optimization), we have worked and are working from an advisory and accounting perspective on various interesting projects such as:

If you are interested in this topic, please do not hesitate to contact us.

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk