The Slovak system of investment taxation is far from tax neutrality and in many cases is in direct contradiction with the declared objectives of the state. Not only does it discriminate against certain forms of investment, but it often unintentionally encourages less secure or foreign solutions. Why is this a problem and what are its implications?

Tax neutrality means that the level and form of taxation should not favour or disadvantage a particular type of investment. However, this is not the case in Slovakia.

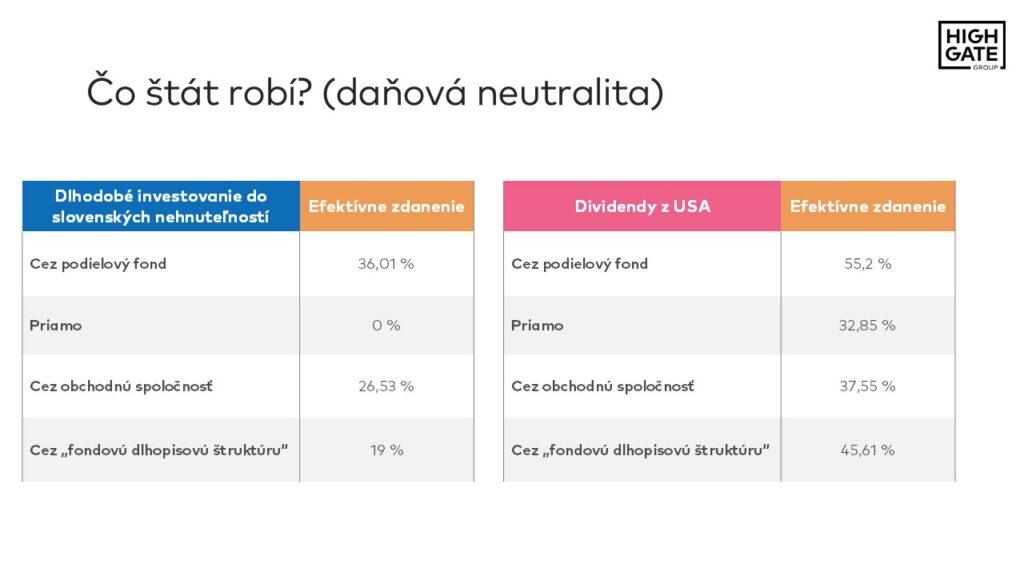

Practical examples show that the same investment in real estate or securities is taxed significantly differently depending on whether it is made by an individual directly, through a trading company or through a regulated mutual fund.

In many cases, regulated structures – which provide greater investor protection and market stability – are at a tax disadvantage compared to simpler, less regulated and riskier solutions.

Slovakia has a number of tax instruments that motivate long-term savings – for example, the exemption of returns after 12 months, the third pillar or long-term investment savings (DIS).

Read together, the state is sending a clear signal: we support long-term and safe investing.

But the reality is the opposite. The current tax regime often favours direct investment in riskier assets (e.g. foreign equities or development projects through bond structures) at the expense of domestic regulated funds.

Such an approach not only weakens the domestic investor infrastructure, but also leads to a paradox: the Slovak taxation setup increases the tax revenues of other countries instead of our own.

On top of the problems with tax neutrality, there is a larger and more dangerous phenomenon – the declining quality of lawmaking.

An example is the Financial Transaction Tax Act, which contains vague definitions, lacks a logical structure and does not take into account practical market situations.

Without improvements in the legislative process and in the state’s professional capacity, it will be difficult to see systemic solutions that are consistent and predictable.

If Slovakia wants to build a stable capital market and motivate investors to make long-term and safe investments, it needs to return to the principle of tax neutrality and align tax policy with its own stated objectives. It is also essential to improve the quality of legislative drafting so that laws are not a source of chaos but of certainty.

We are the Highgate Group, modern advisors for your law, tax and accounting under one roof.

Subscribe to our newsletter for more analysis and practical advice from the business world.

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk