In the first comprehensive lecture on Conference on Cryptoassets, which we organized on October 24, 2024 at the Radisson Blu Carlton Hotel with Peter Varga together with Roman Baranc address key aspects of doing business and investing in cryptoassets, particularly with respect to the important legal, tax, accounting and regulatory contexts. For those who were not able to attend the conference, this article provides a brief overview of the various topics covered in this presentation. Of course, if you are interested, you can view a recording of this lecture, or a recording of the whole conference.

This part of the conference began with a brief historical excursus on how cryptoassets were affected by the regulation of tax and financial law before separate comprehensive legislation governing cryptoassets and DLT was enacted. For example, we addressed the 2019 opinion of the European Banking Authority (EBA) that cryptoassets could be considered electronic money if they met all the characteristics of electronic money. In the area of financial instruments, the European Securities and Markets Authority’s 2018 to 2019 review was a breakthrough. One of the results of this survey conducted among national regulators of EU member states was that cryptoassets that fulfil the characteristics of financial instruments should be regulated in the same way as financial instruments. At the same time, national regulators noted the need to adopt legislative changes that reflect the specific form of crypto-assets, which can be considered as one of the important drivers for the adoption of comprehensive regulation of crypto-assets. The lecture continued with the intersection of cryptoassets and the regulation of collective investment, AML, income tax or VAT.

By far the best known and most comprehensive piece of legislation governing cryptoassets is the MiCA Regulation[1]. The MiCA Regulation is a robust piece of legislation which, amongst other things, aims to create regulation for several areas of the cryptoasset business that have been covered by no regulation at EU level. However, in addition to the MiCA Regulation, cryptoassets are regulated directly or indirectly by a number of pieces of legislation, most notably the following:

Under the MiCA Regulation, we can classify cryptoassets in different ways. One such division is between crypto-assets that are subject to the MiCA Regulation and those that are not.

The MiCA Regulation regulates the following cryptoassets:

ART and EMT are stablecoins for which the MiCA Regulation prohibits interest. Cryptoassets other than asset-linked tokens or electronic money tokens are a broad group of cryptoassets that do not qualify as ARTs or EMTs, nor do other cryptoassets excluded from the scope of the MiCA Regulation. For example, in order to offer certain crypto-assets to the public, a legal opinion is required which analyses in detail why and how the crypto-asset in question has been classified in a particular category of crypto-assets.

We may also consider non- fungible tokens (“NFTs“) to be cryptoassets which, if they meet certain characteristics, are exempt from the MiCA Regulation and are not currently subject to any regulation. Financial instruments, deposits, funds (which are not e-money tokens), pension products and various other instruments may also be classified as crypto-assets They are all regulated by separate legislation, whether or not they take the form of crypto-assets.

The next part of the lecture was devoted to various investment structures with cryptoassets. Cryptoasset businesses can raise capital through a variety of structures that are regulated to varying degrees. Such structures are crowdfunding, issuance of financial instruments (e.g. bonds), issuance of cryptoassets, joint ventures or various fund structures.

In the case of investment funds, their link to cryptoassets can be as follows:

Whether cryptoassets other than asset-linked tokens or electronic money tokens (e.g., BTC) may be an investment asset in which an investment fund may invest depends on the type of investment fund. In the basic division of investment funds into UCITS funds and AIF funds, it can be noted that UCITS funds cannot directly invest in crypto-assets such as BTC (however, some regulators in the EU allow these funds to invest in crypto-assets indirectly or through some specific financial instruments), whereas for AIFs it depends on the type of the specific fund. Some AIFs that are harmonised at EU level may also invest in crypto-assets such as BTC.

MiCA does not apply to so-called tokenised financial instruments. These are financial instruments that are classified as crypto-assets, which have advantages over traditional financial instruments such as:

A separate regulation for certain tokenised financial instruments is the DLT Regulation, which creates a pilot regime for so-called DLT financial infrastructures through which transactions in tokenised financial instruments can be stored, traded and settled.

Crypto-assets are also a challenge for tax authorities. There are a number of variables in the taxation of crypto-assets which must always be assessed and evaluated on an individual basis. The tax legislation, especially in the Slovak Republic, is highly opaque and in many cases not entirely predictable. Also, the rules for accounting for crypto-assets do not always reflect current technical or legislative developments in the field of crypto-assets. At the conference, we also addressed the following tax and accounting issues related to cryptoassets:

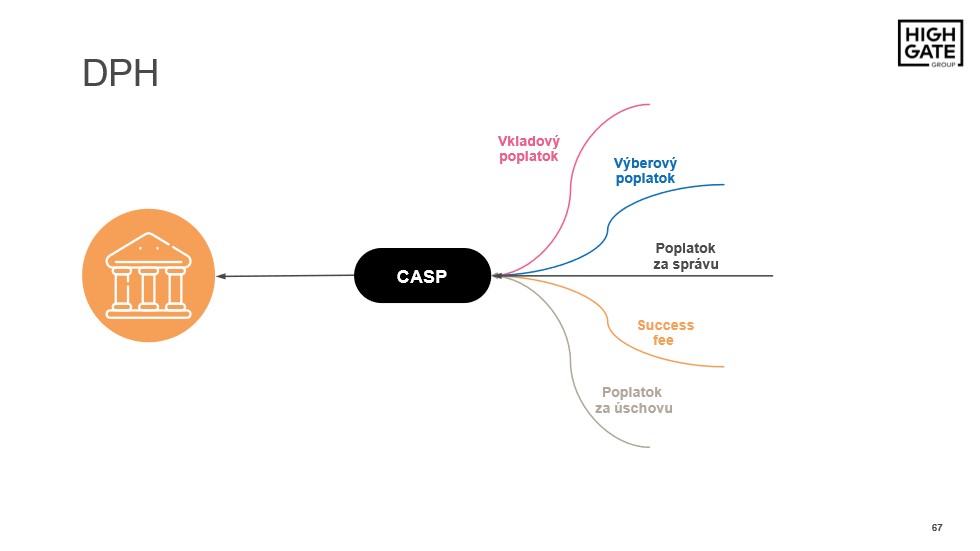

A separate category is VAT, the treatment of which must always be examined separately. In the case of cryptoasset service providers alone, different charges may be levied within their business model, the VAT treatment of which is considered separately.

At our cryptoassets conference, we covered a number of issues in addition to the above topics on cryptoasset law, taxation and accounting.

If you are interested in this topic, please do not hesitate to contact us:

For more on the legal, tax and accounting regulation of cryptoassets, see this section of our website: crypto and legal and tax structures.

If you are interested, you can also subscribe to our newsletter about interesting practical legal and tax information free of charge: subscribe to newsletter

Alternatively, you can address your specific questions in a consultation with our partner Peter Varga, who specializes in financial regulation (including cryptoassets) and tax law. You can book a consultation here:

[1] Regulation (EU) 2023/1114 of the European Parliament and of the Council of 31 May 2023 on cryptoassets markets and amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EU and (EU) 2019/1937 (“MiCA Regulation“)

[2] Regulation (EU) 2022/858 of the European Parliament and of the Council of 30 May 2022 on a pilot regime for market infrastructures based on distributed ledger technology and amending Regulations (EU) No 600/2014 and (EU) No 909/2014 and Directive 2014/65/EU (“DLT Regulation“)

[3] Regulation (EU) 2023/1113 of the European Parliament and of the Council on data accompanying transfers of funds and certain crypto-assets and amending Directive (EU) 2015/849

[4] Regulation (EU) 2022/2554 of the European Parliament and of the Council of 14 December 2022 on digital operational resilience in the financial sector and amending Regulations (EC) No 1060/2009, (EU) No 648/2012, (EU) No 600/2014, (EU) No 909/2014 and (EU) 2016/1011

[5] Council Directive (EU) 2023/2226 of 17 October 2023 amending Directive 2011/16/EU on administrative cooperation in the field of taxation

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk