The topic of ESOPs has long been a topic of interest to the Highgate Group, both from a tax, legal and practical/commercial perspective. ESOPs are still a very topical and hotly debated topic in the business environment, which is also felt in our practice, as we are being approached by more and more start-ups as well as established companies in order to set up complex employee share-based remuneration arrangements. It can be said that employee shares are becoming standard in Slovak companies as well.

We have been actively involved in ESOPs for several years, we even organized a unique conference on this topic, the record of which you can see on the link Employee Stock Ownership Plans (ESOPs) from a legal, tax and practical perspective – a recording of our 2023 conference. V rámci konferencie sme sa zamerali na zrozumiteľné demonštrovanie best practices jednotlivých typov ESOP štruktúr. This is in terms of economic and psychological adjustment within the company as well as parallel legal and tax structuring (tax optimization). Based on the positive reactions, we believe we have succeeded.

Basically, it is an employee benefit where the employer offers the employee options for business shares or the business shares or stocks themselves. This gives the employee the opportunity to participate to a certain extent in the company itself and thus motivates him to achieve higher work efficiency in order to achieve higher profits for the company, which ultimately means higher financial remuneration for the employee.

Employee shares have several advantages, but not only for the employees themselves but also for the employers.

Most often, we emphasize the importance of setting up the entire structure right in the early stages of the ESOP program, taking into account the potential growth of the company, the entry of an investor or even legislative innovations that can make the existing ESOP program more effective if set up correctly.

ESOPs are a complex topic that is not enough to look at only through a legal and tax lens. In the first step, of course, it is important to work with the ESOPist’s vision and knowledge of the company that intends to set up an ESOP program. Subsequently, other issues such as:

Our task is therefore to take into account all relevant facts for the client “under one roof” and to provide the most ideal economic, legal and tax-tax setup of the option program, including services such as:

The ESOP concept brings with it many concepts, and it is necessary for the client to think about them before we start setting up a specific strategy for him or her. It is mainly a decision on what conditions will be set in the ESOP. It mainly concerns:

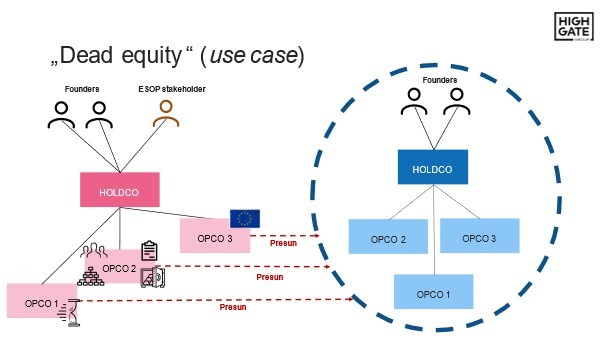

As we have outlined above, ESOPs act as a powerful motivational and rewarding tool to attract and retain employees or reduce turnover in the company. At the same time, it motivates employees to perform better at work, which is also linked to the growth of the company. However, this is only true if the ESOP is set up correctly and efficiently. In practice, we also encounter the opposite situations where we have to deal with “dead equity” in the company, namely a “non-working ESOPist” who has already been assigned a real, tangible stake in the company.

A poorly set up ESOP can also have a demotivating effect on employees, which is the opposite of the purpose of such a program. For example, after the vesting period, an employee may lose the motivation to perform his or her job as effectively as during this period of share maturation. Therefore, it is necessary to set up the ESOP in such a way that the employees have an incentive to work or stay in the company even after the “vesting period” has expired.

One of the reasons for employee demotivation can be the poor setting of Good Leaver / Bad Leaver conditions. In practice, we often deal with a variety of “bad leaver” situations, most of which require a sophisticated and complex approach. Therefore, it is most ideal for companies to set these conditions upfront as a precaution in clear and practically enforceable language and manner. Of course, setting a fair playing field also applies to the “good leaver” situation.

When setting up an ESOP, it is more than desirable to comprehensively anticipate all potentially problematic situations and one of them is the possible dispute about the value of the share and therefore how to determine the “fair market value” (FMV), what methods to use to value a company or, for example, a Start-up with a unique product and difficult predictability of its development in the next stages, and who to contact to develop the FMV for your business model.

The company has a choice as to what kind of “shares” it offers to its employees. In the conditions of the Slovak Republic it is in particular:

Already at this step, when choosing the type of shares, it is necessary to consider the economic and tax-tax implications. The choice of the type of shares is undoubtedly linked to the choice of the legal form of the ESOPist, where our legislation gives us four options to choose from, the choice of which depends on the specific realities of the intended structure, namely:

Each legal form has its specifics, or its advantages and disadvantages. Already at our conference we outlined the substantial advantages of the less used legal form of the cooperative, as well as the use-casey of a proper set-up in practice. It is important to note, however, that there is no such thing as the “most correct” choice of legal form, but in any case it is very important to make a comprehensive assessment of which legal form is the most “ideal” choice for a given case.

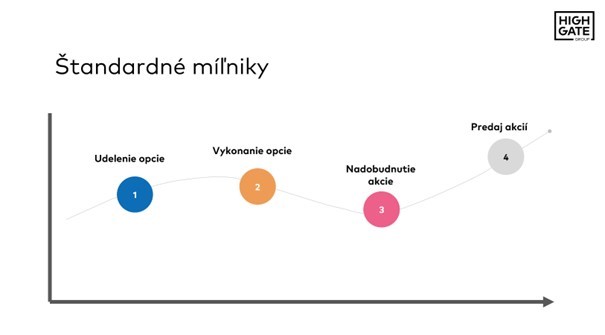

ESOPs entail certain “milestones” which also need to clearly set the conditions under which they occur. We mean the following:

In the case of employee shares, a fundamental problem arises in practice from our point of view, namely the question of the timing of taxation. The Income Tax Act provides for the accrual of non-cash income – taxation – at the time of acquisition of employee shares by the employee. In the case of options, there are views that the moment of taxation occurs even a little earlier. However, such a procedure contradicts the principle of taxation, where taxation on the acquisition of employee shares is to occur at a point in time when neither the employer nor the employee has cash income on which tax and levies can be paid.

For our clients, we therefore try to find legal ways to set up the ESOP structure so as to divert the moment of taxation to the moment of actually received cash income, or to reduce the rate of taxes and levies, or to minimize the risks of a possible tax audit.

As we said in a number of case studies and at the conference, each client needs to be considered on an ad hoc basis, and there is no sort of one-size-fits-all formula that just rolls over to the firm without knowing the client’s requirements. In any case, we will be happy to create and run a tailor-made solution for your business with an optimal mix of legal and tax-efficient structure.

The 2023 amendment to the Income Tax Act has sparked a positive response within the startup environment. Under the rules in effect prior to this amendment, a critical portion of shares awarded to an employee or contractor had to be taxed as non-cash income. In practice, therefore, various arguments and structures have been devised to eliminate this risk. The amendment was intended to shift this taxation to the moment of realisation of income in the form of an “EXIT” share.

However, despite the certainly noble motive, the amendment did not fully address this need and it appears that it may be unused in practice without fiscal risks. We have addressed this more fully:

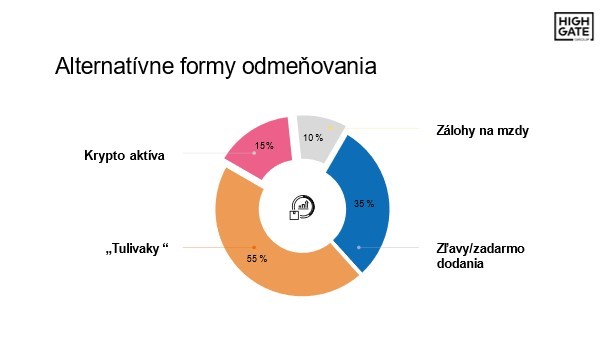

As the ecosystem around cryptoassets develops, we are increasingly seeing the distribution of various cryptoassets to team members. We are also actively working on these topics in practice, as evidenced by our activities, you can read more on the topic of cryptoassets in the following links:

If you are interested in this topic, please do not hesitate to contact us:

For more on ESOPs, see this section of our website: ESOPs – Employee Stock Ownership.

If you are interested, you can also subscribe to our newsletter about interesting practical legal and tax information free of charge: Subscribe to newsletter. Alternatively, you can also address your specific questions in a consultation with our partner Peter Varga, who specializes in tax law and the creation of ESOP structures, among other areas. You can book a consultation here:

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk