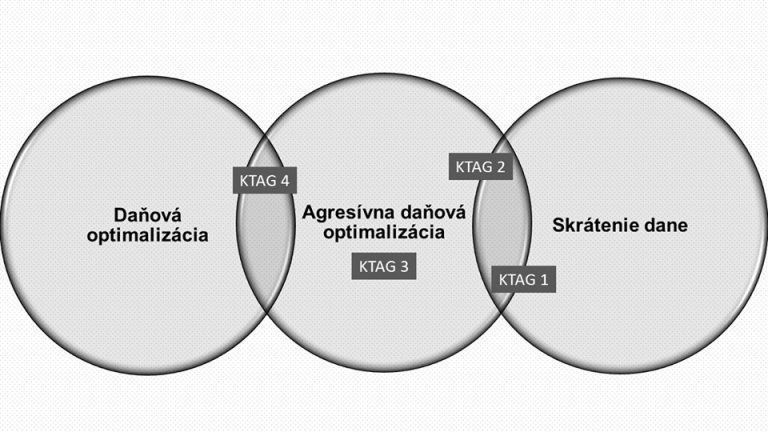

Peter Varga, our partner and tax lawyer, gave an interview to TREND in which he commented on the case of KTAG and Andrej Kiska from the perspective of tax and tax optimization. It was during tax optimization there are situations that cannot be assessed in a completely black and white way, such as the case of KTAG. However, this is not only a problem of Slovak laws and Slovak court practice.

“I would compare it to wild parking in housing estates, where the exact distances from intersections or pedestrian crossings, for example, are not addressed in the long term. If someone suddenly gets a ticket for improper parking, such a practice is without doubt lawful, even if the driver has been standing in that spot for several months without being sanctioned. However, such a leap in the application of the law is sustainable given the size of the fine. The difference with KTAG is that the potential sanction is significantly harsher for KTAG.” says P. Varga.

“Although I don’t have complete information about this case, at first glance it may appear to be a leapfrog solution that at the end of the day may not stand the test of constitutionality because of legal certainty,” says Varga. “It is not the practice that the non-recognition of costs in similar cases automatically creates a criminal dimension,” he adds.

Read the full interview with Peter Varga at https://www.etrend.sk/trend-archiv/rok-2019/cislo-10/kiska-bral-svoju-kampan-ako-netradicne-self-promo.html

The legal and tax analysis of the case can be found published on the tax portal www.danovespravy.sk

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk