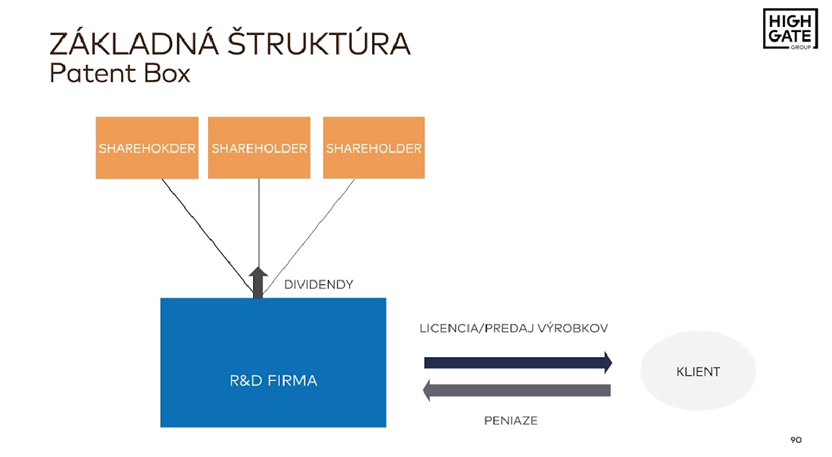

Slovakia offers a great opportunity for IT companies and innovative businesses to reduce their tax burden. Patent Box allows companies that develop software or other technical solutions to pay income tax at half the tax rate. This scheme eliminates the need for complicated cross-border structures and gives companies the opportunity to optimise their costs directly on home soil.

As Peter Varga writes in his article “Slovakia can be a tax haven too!”The Patent Box represents a significant step towards Slovakia competing with other tax regimes in Europe. Although the country introduced this system later than its neighbours, it provides Slovak IT companies and development centres with a tool for legal tax optimisation. Why should you consider using it? This article will give you an insight into how Patent Box works and what benefits it brings to innovative companies in Slovakia.

Imagine being able to exempt up to 50% of your profits from income tax. That’s exactly what Patent Box offers for companies that invest in research and development in Slovakia. This unique tax regime brings exceptional benefits especially to IT companies and other innovative companies that create:

However, Patent Box goes even further – the income tax exemption also applies to profits from the sale of products in the manufacture of which your patented invention or technical solution has been used.

This means you can maximise your profits, encourage further investment in innovation and legally reduce your tax costs.

Patent Box represents a significant step in the promotion of research and development in Slovakia. This tax instrument allows companies to significantly reduce their tax burden by exempting up to 50% of the revenues derived from:

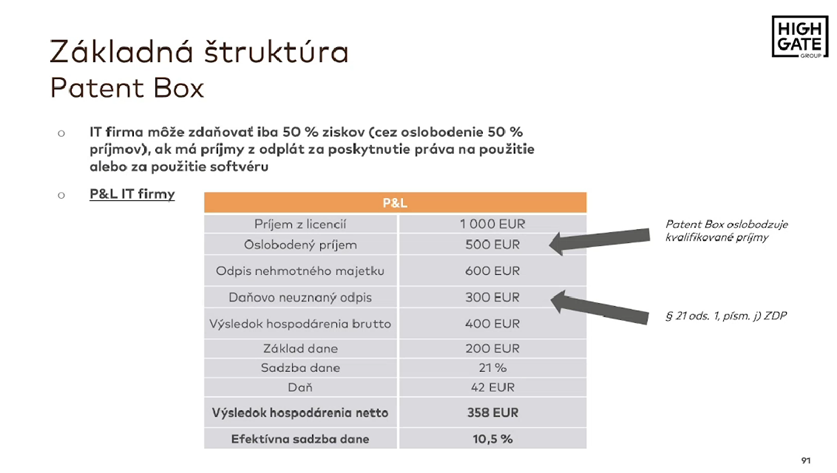

In other words, if a company accounts correctly and meets the required conditions, it can effectively reduce its corporate tax rate to 10.5% instead of the standard 21% (for 2025, the 21% tax rate applies to a company with taxable income between EUR 100,000 and EUR 5,000,000) thanks to the Patent Box.

The Patent Box thus exempts from income tax up to 50% of the profits that the taxpayer earns from royalties for the grant of a right to use or for use:

The Patent Box also allows taxpayers to benefit from this exemption from income tax if they derive income from the sale of products which are the result of research and development carried out by the taxpayer and in the manufacture of which an invention protected by a patent or a technical solution protected by a utility model has been wholly or partially used.

The patent box under Section 13a of the Income Tax Act allows for an exemption of 50% of the proceeds from the licensing of the use of patents, utility models and software created by the tax entity’s own research and development. Other related regimes (Sections 13b and 30c) provide for exemption of income from the sale of products made using a protected invention and a deduction of 100% of research and development expenses. It is the above provisions of the Income Tax Act that provide quite extensive tax benefits that are linked to research and development and the associated creation of intangible assets.

The taxpayer can achieve an effective tax rate of 50% of his standard tax rate through the Patent Box. As we often combine Patent Box with Supercomputing for clients(Peter Varga on the use of Patent Box and Supercomputing for Touchit), the effective tax rate can thus be 0% for a number of years if set up correctly and diligently.

Let us imagine a situation where an IT firm carries out an experimental development after completion of which it has licensing revenue. Assume that the company will record revenues and expenses as shown in the table below (amounts are in EUR):

| ROK | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|---|

| Proceeds from the sale of licences | 0 | 0 | 200 000 | 500 000 | 750 000 | 1 000 000 | 1 200 000 |

| Relevant R&D costs | 250 000 | 250 000 | 0 | 0 | 0 | 0 | 0 |

| Write-offs | 0 | 0 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 |

| Other costs | 25 000 | 50 000 | 75 000 | 100 000 | 125 000 | 150 000 | 175 000 |

| Profit | 25 000 (loss) | 50 000 (loss) | 25 000 | 300 000 | 525 000 | 850 000 | 925 000 |

| Supercomputing | 625 000 | 625 000 | 12 500 | 150 000 | 262 500 | 425 000 | 400 000 |

| Tax | 0 | 0 | 0 | 0 | 0 | 0 | 13 125 |

| Effective rate | 0 % | 0 % | 0 % | 0 % | 0 % | 0 % | 1,4 % |

The basic prerequisite for the effective use of the Patent Box is the implementation of research and development activities and the correct accounting of these activities. Experience, particularly from audits of the accounting records of young IT companies, has shown that many of them are incorrectly accounting for software development. In doing so, they not only violate the Accounting Act, which can lead to a fine of up to 2% of the value of their assets, but may also unduly reduce their tax liability and disqualify themselves from the Patent Box.

It is therefore essential to account properly for the Patent Box and plan for its use in advance. In addition, the Patent Box legislation requires the taxpayer to use its own research and development results. In other words, the results must be produced by the taxpayer’s employees who are part of the taxpayer’s staff.

However, due to the high tax-tax burden on labour, many entrepreneurs find it more economically advantageous to work with contractors (self-employed or one-person LLCs), who are subject to a lower tax-tax burden(see our posts on the issue of “employing contractors”). In certain circumstances, and with properly drafted contracts covering the creation of works and other intangible results, this requirement can be waived. However, if a taxpayer fails to retain the services of an attorney experienced in Patent Box, it may negatively impact its ability to utilize the Patent Box.

The Patent Box should therefore be seen as a complex instrument, the proper use of which requires knowledge of tax law, accounting and intellectual property law.

As we have already outlined, the Patent Box is an important tax instrument that supports businesses investing in R&D by allowing a reduction in the tax burden on the proceeds of intellectual property. However, for its use to be effective and legally compliant, a number of rules relating to accounting, ownership of results and contractual relationships need to be respected. The following rules serve as a basis for the correct application of the Patent Box and minimising risks.

This issue is quite complex and involves both legal and tax accounting aspects. The issue was discussed in detail by Peter Varga at a conference on legal and tax optimization for technology companies.

In certain circumstances, a company may work with outsourcers without affecting its eligibility for Patent Box tax benefits. However, the key is for the company to adjust the factual and legal position to meet all the requirements of the legislation. We can help you with just that here at our company under one roof.

The Patent Box topic is one of our key areas of expertise, which we address regularly and in depth. We publish articles, give presentations at professional conferences as well as methodological and commercial events. To find out more, take a look at our publications, media releases, videos or conference recordings.

Together with our experienced attorneys, we provide clients with comprehensive support in the Patent Box application process. Our services include:

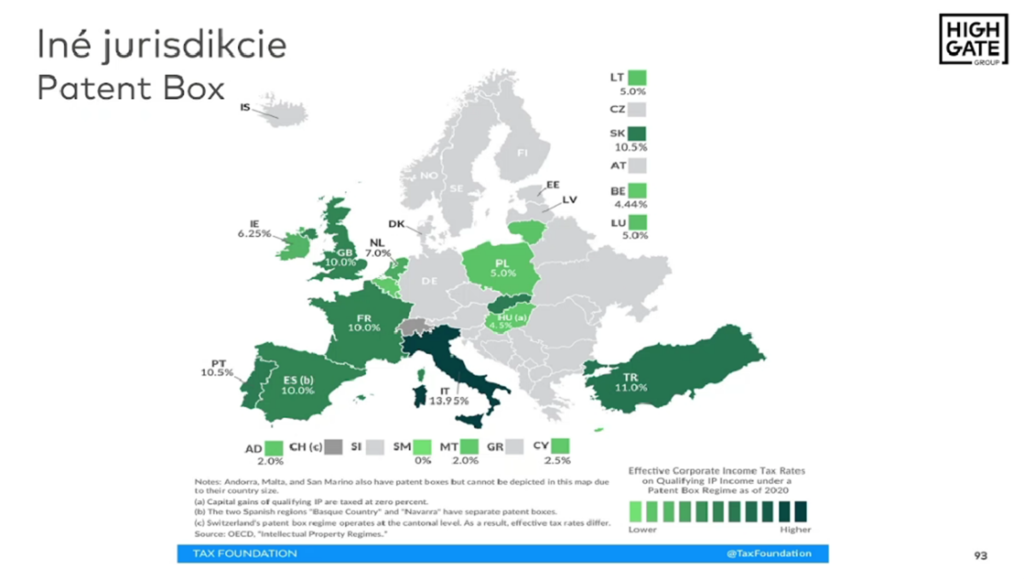

The origins of the Patent Box can be traced back to the 1970s in Ireland. years of the last century. Legislation at the time allowed companies licensing certain forms of intellectual property to reduce their income tax. The concept has been gradually applied by other countries, including France, Luxembourg, Cyprus and the UK. Recently, it was quite common to set up an offshore company in Cyprus, for example, and benefit from a reduced tax rate of 2.5% on income from the use of intellectual property when invoicing within the group.

The Patent Box concept is very popular today legislatively. Everywhere, however, the so-called. nexus principle, which prevents tax abusive practices. As can be seen from the figure below, Slovakia ranks among the progressive countries in this respect.

If you are interested in this topic, please do not hesitate to contact us:

Peter Varga, e-mail: peter.varga@highgate.sk

For more on tax and in particular tax and levy optimisation, see this section of our website: tax and levy optimisation

If you are interested, you can also subscribe to our newsletter about interesting practical legal and tax information free of charge: Subscribe to newsletter.

Alternatively, you can address your specific questions in a consultation with our partner Peter Varga, who specialises in financial regulation and tax law. You can book a consultation here:

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk