Setting up a small investment fund in Slovakia may not be difficult in some cases. It is the subsequent management and distribution that can be more complicated. Small and affordable investment funds are only minimally regulated in Slovakia, but investments in such funds are primarily intended for a limited range of investors, as such investments are considered riskier and the legislator seeks to protect the retail investor from them and to prevent the outbreak of systemic risk.

The term investment fund is also referred to in Slovak legislation as a collective investment undertaking. Although an investment fund does not have a separate definition, it can be interpreted through the term “collective investment”, which is “a business whose object is to collect money and money-valuable values from investors in order to invest in accordance with a defined investment policy for the benefit of the persons whose money and money-valuable values have been collected.”[1] If we break this definition down, an investment fund has the following conceptual features:

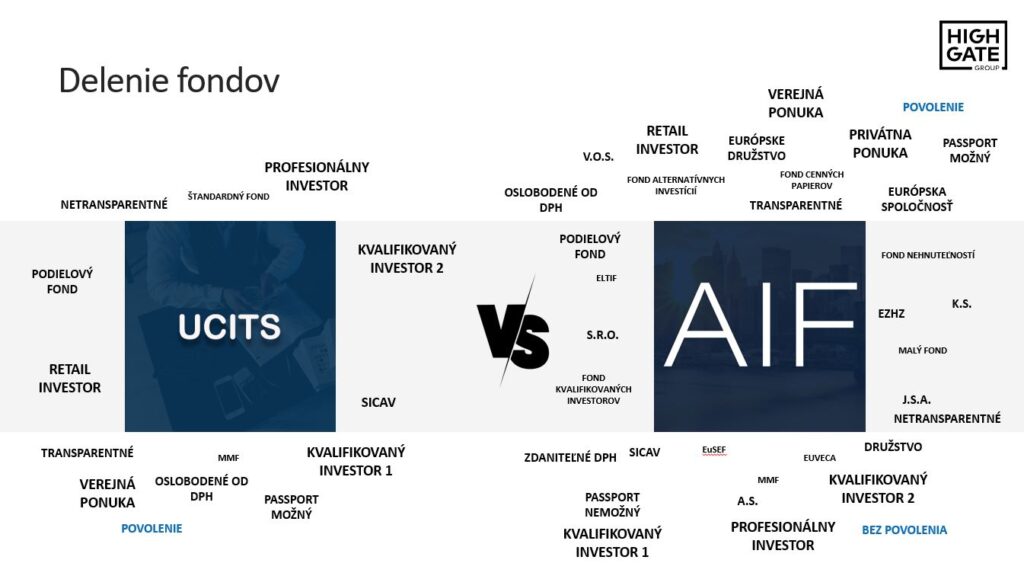

There are a large number of investment funds that can be divided according to different criteria. We can divide investment funds according to their investment policy, legal form, method of taxation, whether they can be offered only in Slovakia or also abroad, according to which investors they can be offered to, or even according to whether their establishment requires a permit or, for example, just registration. At the same time, there is also a range of foreign solutions, which tend to be more interesting for some Slovak fund promoters in our advisory services. However, this always needs to be assessed on an individual basis, taking into account various aspects including cost, investment policy or type of investors.

We also discussed the division of investment funds at our conference Real Estate – Taxes and Financingwhere we visually illustrated this division as follows:

A recording of the relevant conference session where we addressed this topic is also available on our website.

As can be seen from the above graphic, the basic division of investment funds according to their investment policy is into two large groups, namely:

UCITS funds, referred to as standard funds under the Collective Investment Undertakings Act, are investment funds with a strictly limited investment policy that focuses primarily on highly liquid securities. Alternative investment funds are, simply put, those investment funds that do not qualify as UCITS funds. Alternative investment funds cover a wide range of collective investment vehicles, ranging from investment funds that invest exclusively in real estate or, for example, only in defined financial instruments, to a variety of alternative investments, but they also include investment funds that may invest, for example, in crypto-assets.

We define a small investment fund as an alternative investment fund, which is not harmonised by default at the level of European law and is regulated by the Collective Investment Schemes Act. Small investment funds are managed by managers that are not subject to harmonised regulation, with a maximum value of assets under management:

Whether a small investment fund is suitable for a particular investment structure is individual. Some of our clients prefer this option for its more flexible form. Others prefer more robust structures or possibly foreign. At the same time, tax aspects (asset taxation, VAT, management fee, carry interest, performance fee, …) also come into play, which are extremely important in the composition of the investment structure.

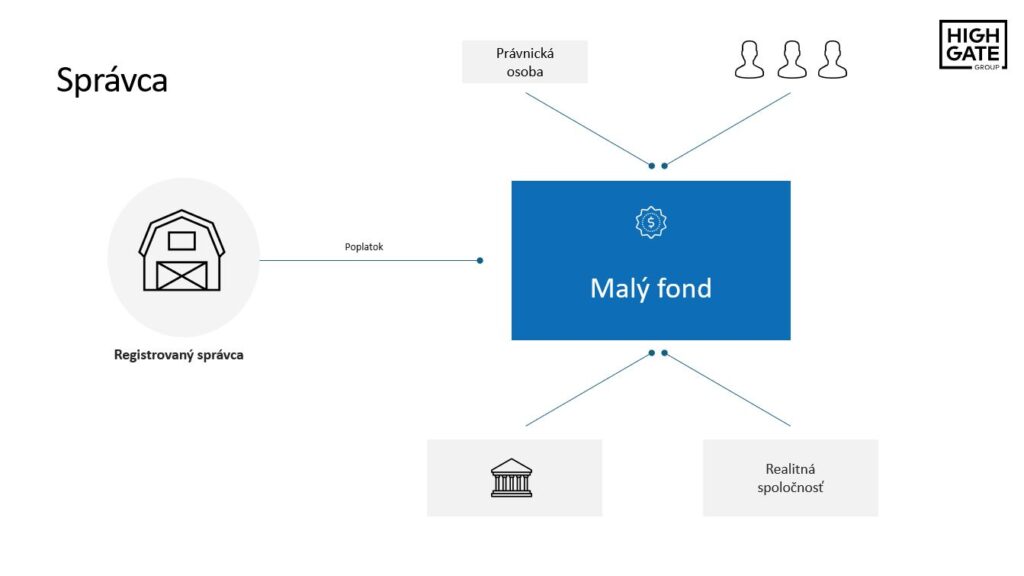

For small investment funds, the question of the form of governance of such a fund is key. Not only in Slovakia, but also abroad, this issue is the subject of VAT and the method of paying managers from the fund. Therefore, somewhere it may be more advantageous for the fund to be self-managed or to be managed by an external manager as we can see in the picture:

The establishment of a small investment fund requires less intervention from the National Bank of Slovakia. This is a double-edged weapon in a way. Some of our clients are comfortable with it and some are not. . Obdobne to platí aj pri správcovi takéhoto fondu. Malý investičný fond je vždy obchodnou spoločnosťou alebo družstvom, ktorý je po jeho založení (pričom proces založenia je rovnaký ako pri iných obchodných spoločnostiach alebo družstve) je potrebné registrovať v registri vedenom Národnou bankou Slovenska.

Registering a small investment fund is a relatively straightforward process. It is therefore preferred by some clients for its flexibility and relative time-saving nature. Of course, there are structures where, despite the relative regulatory simplicity, fund formation is prolonged due to the complex corporate set-up.

Separate rules govern the registration of so-called European Venture Capital Funds(EuVECA), where the registration process, and the conditions that the EuVECA manager must meet, are considerably more complicated. We have assisted two EuVECA funds to set up and register in Slovakia so far (and more have not yet been registered with the National Bank of Slovakia), and this process can take several months.

One of the big disadvantages of a small investment fund is the limited range of investors to whom the fund’s shares can be distributed. In practice, for some types of investment policies, it is even impossible to meet these regulatory requirements. It is therefore important to bear in mind the practical nuances, ESMA interpretations as well as the approaches of the National Bank of Slovakia when structuring and setting up the fund.

We wrote about the distribution of small investment funds, and how it might change in the future a detailed article published on our website.

The investment policy of most small investment funds is not determined by legislation. . Notwithstanding this, every investment fund must have a predetermined investment policy, and this investment policy is usually contained in the constituent documents or the articles of association of the investment fund.

Those small investment funds that have regulatory flexibility can invest in a wide range of assets, including financial instruments, real estate, various alternative investments, as well as crypto-assets.

The distribution of holdings and securities of most small investment funds domiciled in Slovakia is limited to the territory of the Slovak Republic. This is because these funds are not harmonised and therefore their managers cannot benefit from the passport. In practice, therefore, it is important to keep in mind the legal ways and boundaries that the legislation allows to address investment opportunities for foreign investors as appropriate.

A number of small investment funds are subject to the same taxation rules as standard capital companies. However, selecting the right form of investment fund and overall investment structure is key to a tax-efficient structure. In practice, however, its selection depends on the individual characteristics and needs of the investment structure.

In general, however, venture capital funds, for example, would certainly appreciate more flexibility in the inclusion of losses on the disposition of investment assets. Investment funds investing in crypto-assets would be happy not to tax non-cash income earned on trading platforms, and the fund market would also be encouraged by a broader exemption from capital gains tax. And the obligation to annually revalue certain types of investments using the tax-impacted income method may deter many potential Slovak fund founders.

On the other hand, the non-taxation of dividends (with some exceptions) at the corporate level, even for portfolio investing, is perceived very positively.

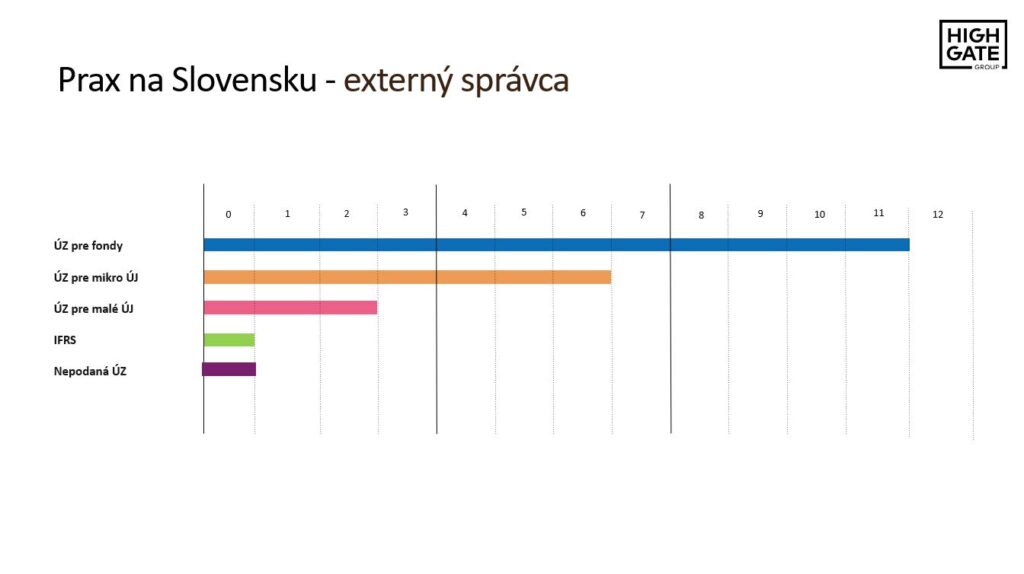

The accounting of SIFs is specific and subject to different rules from those of double entry accounting. Moreover, the ambiguity of these specific accounting rules often causes interpretation problems. The fund industry would benefit from a major overhaul of these rules, which would not only reflect current investment trends but also substantially reduce the administrative burden. It is not reasonable to expect small funds to value their startup investments annually using the discounted cash flow method.

When we did our research in 2023 on how small investment funds are accounted for, we found that more than half of the financial statements were filed incorrectly, and there was also a significant discrepancy in the accounting for these funds. The result of our survey was as follows:

We advise our clients first and foremost in selecting the appropriate investment structure for their planned business model, from a legal, regulatory, tax and accounting perspective. When setting up a small investment fund, a number of questions need to be answered, particularly with regard to which investors such a fund is to raise funds from, in which countries it is to be offered or in which assets it is to invest. If the result of such an analysis is that a small investment fund is an appropriate choice, we advise the client on structuring the fund, setting it up, choosing the appropriate legal form, including the preparation of the relevant documentation. We are one of the few advisors in Slovakia to have established several investment funds with variable share capital, so-called SICAV funds, which represent a unique type of joint stock company designed exclusively for collective investment purposes. At the same time, of course, we also process the overall communication with the National Bank of Slovakia for our clients.

At the same time, for small investment funds we also provide comprehensive accounting servicesincluding reporting to the National Bank of Slovakia.

The area of financial regulation, including collective investment, has long been one of the flagships of our advisory practice. We have set up several investment funds for clients, including investment funds in the legal form of SICAVs or EuVECA funds (as the only ones in Slovakia). We provide continuous legal, tax and accounting advice to these clients.

Our extensive experience in the area of financial regulation is demonstrated by, among other things, the successful conferences (some of the largest of their kind in Slovakia) that we have organised, whether in relation to real estate financing or regarding the establishment and operation of investment funds.

At the same time, in the prestigious competition Law Firm of the Year 2024, we won the “Capital Markets” category.

If you are interested in this topic, please do not hesitate to contact us:

Alternatively, you can address your specific questions in a consultation with our partner Peter Varga, who specialises in financial regulation and tax law. You can book a consultation here:

[1] Section 2(1) of Act No. 203/2011 Coll. on collective investment, as amended (hereinafter referred to as the “Collective Investment Act“).

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk