The Švarc system, otherwise known as “employment” of tradesmen or contractors (employment on a trade), is a topic that has been resonating in the Slovak business environment for decades. The main motive why entrepreneurs prefer sole traders over employees is the obvious tax-tax advantages. However, such an arrangement poses several challenges concerning levies, taxes, but also criminal law. At Highgate, we have been addressing this issue for a long time on the legal, regulatory as well as tax and levy side. That is why we recently held a comprehensive conference on this topic and setting up relationships with contractors (Schwarz System Conference for more information). During the lectures, Peter Varga focused on a wide range of issues and provided a comprehensive view of the situation, which affects not only entrepreneurs, but also individuals. If you have any questions, would like to view a recording of the conference, are interested in a comprehensive service or consultation, we are at your disposal.

The Schwarz system is mainly regulated by law č. 82/2005 Z. z.., which defines several types of illegal work, but primarily prohibits the classic shvarcsystem (illegal work for a living). It is understood by law as dependent work performed by an individual for an entrepreneur without an employment relationship or a state employment relationship existing between them. The prohibition of the shvarcsystem applies on both sides – to the person who works and to the recipient of the work.

The performance of work by a self-employed person for an entrepreneur cannot in all circumstances be subsumed under the definition of a shvarcsystem. The essence is that the characteristics of dependent work, which are found in Art. 2 of the Labour Code, under which it is the work performed:

If all of the above conditions are met, we are talking about a dependent activity that can be carried out exclusively in an employment relationship.

In the case of tax administration and tax authorities, the issue is that of dependent activities, which is regulated in Section 5 of the Income Tax Act. Simply put, a dependent activity is a situation where a person is obliged to follow the instructions or orders of the payer of the income. A mechanical interpretation of dependent activity could lead to the erroneous conclusion that any instruction or direction given to someone is a dependent activity. Such an interpretation would not only be totally illogical, but more importantly, it would not reflect the state of affairs and the purpose which the legislature sought to achieve by the above formulation.

It is important to understand that the concept of dependent activity is broader than the concept of dependent work. This means that all dependent work is dependent activity, but not all dependent activity is dependent work. This distinction is key in controlling and sanctioning the shvarcsystem.

In the early 90s. years, entrepreneur Miroslav Švarc founded the construction company Švarc s. r. o. The vision of many after the fall of the regime was clear and that was to stand on their own feet and make money. In this case it was no different, Švarc decided to employ freelancers very soon after the establishment of the company, in this way he did not have to pay compulsory contributions and he could terminate the employment relationship at any time. The attraction for people was the increased wages compared to what they would have had if they had been employed. The company quickly began to make billions of euros in sales and did so well that it became a sponsor of the Benešov football club. Thanks to Mr. Švarc’s cash injections, the football club made it all the way to the first league.

At the time, no one knew that the name of the famous billionaire would soon become the name of an illegal way of employing freelancers. It wasn’t long before the state stopped liking the fact that he was losing quite a lot of money. A law was passed that officially outlawed the shvarc system. After the ban, Švarc’s life took a quick turn. He was first fined several times, then charged with embezzlement of social security benefits, and finally sentenced to three and a half years in prison for tax evasion.

At first glance, it would seem that this story was so intimidating that no one would want to risk it anymore, well the opposite became true. Nothing has changed by banning or convicting the father of the shvarc system. People are still trying to find ways to get around the ban and enjoy the benefits of doing so. And thanks to generous flat-rate spending, they are trying it today in Slovakia.

The issue of the shvarc system is often perceived as a hunt for a fictitious sole trader (but also a one-person SRO), i.e. a self-employed person (self-employed person) without his own employees. For there to be no doubt that the entrepreneur (a self-employed person or a one-person SRO) is not a sham sole trader, the entrepreneur should meet at least two of the following criteria:

Although this definition is vague and neglects many variables, the state tries to identify and punish such tradesmen because they are “robbing” the public finances, failing to pay pension contributions and other compulsory contributions.

Let’s look at this issue from a different angle. Why is the shvarcsystem so controversial? And what are its real advantages and disadvantages for sole traders and employers? These questions open the way for an interesting debate and bring new perspectives to old problems.

Approximately 300 000 people in Slovakia work for a living. The number of sole traders varies slightly from year to year, with this type of business remaining popular mainly due to the possibility of greater flexibility and potentially higher net incomes. At the same time, it should be added that there is also a significant proportion of sole traders who combine a trade with permanent employment. By comparison, there are approximately 500 000 self-employed persons (self-employed persons) in Slovakia, which includes both sole traders and other entrepreneurs who operate as natural persons. This number varies depending on economic conditions and legislative changes, but has been around this figure for a long time.

In Slovakia, the number of sole traders is constantly growing, which brings us to the question: what motivates people to become sole traders?

One of the main reasons for this is the significant disproportion between the tax and levy obligations of sole traders and employees. This imbalance in the tax system creates more financially advantageous conditions for sole traders, which naturally attracts many who are looking for ways to optimise their income. However, the State is looking critically at this phenomenon and intervening to prevent abuse of the system. It should be noted that if there is such a disparity in the law between the different regimes, the intervention of the state is legitimate.

At the conference, Peter Varga addressed this topic from a different perspective. He stressed that if the tax system were more neutral, the decision of individuals to become a sole trader or an employee would not be considered fraudulent. It would not be an attempt to avoid tax, but a free choice of the legal form that best suited individual needs. In situations where the individual expects social insurance benefits (mainly a pension), the optics are more neutral for a change. Be that as it may, it is the knowledge of the complex perspective of taxes, levies and social insurance benefits that is a prerequisite for a greater likelihood of defending a business relationship with a contractor. In other words, it can be argued from the case law that legal analysis alone is not sufficient and that legal analysis must reflect the existence or non-existence of a financial disproportion in the adjustment of the relationship. These are also the conclusions of our conference.

In the absence of a disproportion, we would be on a level that would allow a freer choice of the appropriate legal form for a particular natural person. Within the relevant legal models, employment, single-person LLCs, trades, but also IP relationships and other forms of cooperation, such as silent partnerships, were presented in more detail. Watch the video recording of the conference to learn more about why working as a sole trader is so attractive and what advantages and disadvantages it brings for both employers and sole traders. A deeper insight into the motivations for using sole traders and the contractual freedom in choosing the legal form is presented by Peter Varga in the video from the Švarc System conference : “Employing freelancers” – where is the limit?

To begin with, the shvarcsystem is financially advantageous for both parties at first sight. The employer does not pay compulsory contributions, is relieved of administrative activities, costs related to the employment relationship and can terminate the relationship with the sole trader at any time.

For example, for a sole trader, the advantages are:

The employee is always the weaker party in employment law, but by switching to the sole trader regime, he loses a number of benefits that he should enjoy in accordance with the Labour Code.

An example would be:

In addition, a self-employed person is entitled to lower social insurance benefits (maternity, pension, unemployment benefit, sick pay, maternity pay, etc.). More about these benefits in the training “Employing” freelancers – where is the limit?

As noted above, the benefits of self-employment cannot be viewed in isolation through the lens of the above tables alone. The complex picture is also completed by the effect on social insurance benefits, the amount of which varies depending on a number of circumstances, including the legal form under which the individual is gainfully employed.

The situation is also different for social security benefits for sole traders and those contractors who provide their services through a legal entity.

The basic condition for entitlement to maternity leave is that the person has been insured for at least 270 days in the two years before giving birth. If the sole trader is in the so-called. is not paying social security contributions as a voluntary insured person, he or she may not be entitled to maternity pay. The amount of the maternity allowance is normally 75% of the so-called the daily assessment base. The daily assessment base is derived from the average of the assessment bases in the so-called. crucial period. The decisive period varies depending on the circumstances of the case. To simplify, the amount of maternity pay for a self-employed person depends on how much and when the self-employed person contributed to social insurance. However, it is precisely in the case of maternity allowance for sole traders that the Social Insurance Act allows for flexibility to reach a situation where the sole trader receives the maximum maternity allowance. The maximum maternity allowance for 31-day months is slowly approaching EUR 2 000 each year. For more information, arrange a personal consultation with Peter Varga. Our accounting clients enjoy a 50% discount.

Generally, a tradesperson may be found unfit for work in the event of illness, accident or isolation/quarantine. The standard amount of sickness benefit depends on the tradesman’s social insurance contributions as well as the type of sickness absence (the amount may be different for pandemic sickness absence).

If the self-employed person meets the conditions for sickness benefit (e.g. he/she is liable for social security contributions or is in the so-called protection period), the amount of sickness benefit is similar to that for employees, namely:

The amount of the daily assessment depends on a number of factors. In general, however, sole traders using flat-rate expenses pay social security contributions on lower tax bases. This also has an impact on the calculation of the daily assessment. It should also be taken into account that a self-employed person cannot estimate the amount of sickness benefit in advance to the same extent as he or she can do for maternity pay.

The nursing allowance has become an important social supplement, for example, during pandemics and school closures. It helped not only the employees/employers but also the employers themselves in terms of cash-flow to get through the difficult pandemic period of a suspended economy.

A self-employed person is normally entitled to sick pay if he or she pays social security contributions or is in the so-called. the protection period. The amount of the sickness benefit also depends on the daily assessment base, which is based on the contributions of the self-employed person to the social system in the so-called. crucial period. The amount of the sickness allowance is 55 % of the daily assessment calculated in this way. Thus, similarly to sickness benefit, the amount of sickness benefit for a sole trader is affected by the lower contribution obligation of sole traders compared to employees.

Although pensions are an abstract topic for many of our clients’ contractors, some of them are still interested in analysing the effects of converting to a trade in terms of future pension income. For pensions, the merit principle is normally applied – the more the insured person contributes to the social system, the higher the pension will be. However, this merit system is influenced by the social element, which is mainly represented by the pension ceilings, the coefficient for higher pensions as well as the minimum pension institution.

For example, if the conversion from employee to sole trader means a lower pension of, say, €200, then with a 15-year pension the total amount is €36,000. And that is the relevant amount. When converting from employment to sole proprietorship, we also analyse this aspect for our clients on request.

A self-employed person is entitled to unemployment benefit only if he or she has paid voluntary unemployment insurance for at least two years in the four years before being registered as a jobseeker. A self-employed person must pay voluntary unemployment insurance to qualify for this benefit.

The amount of the benefit is 50 % of the daily assessment base, which is based on the average of the assessment bases in the reference period. The reference period is different for unemployment benefit than for maternity or sickness benefit, for example. The decisive period for establishing the daily assessment base is the two-year period preceding the date on which entitlement to unemployment benefit accrued.

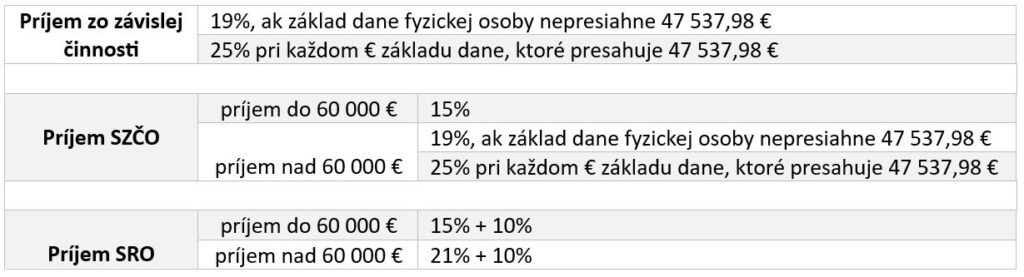

The motivation of market participants on the part of employees is to seek other forms in order to increase their income. For better clarification, we also provide a summary of the tax rates, the basic models that frame the issue

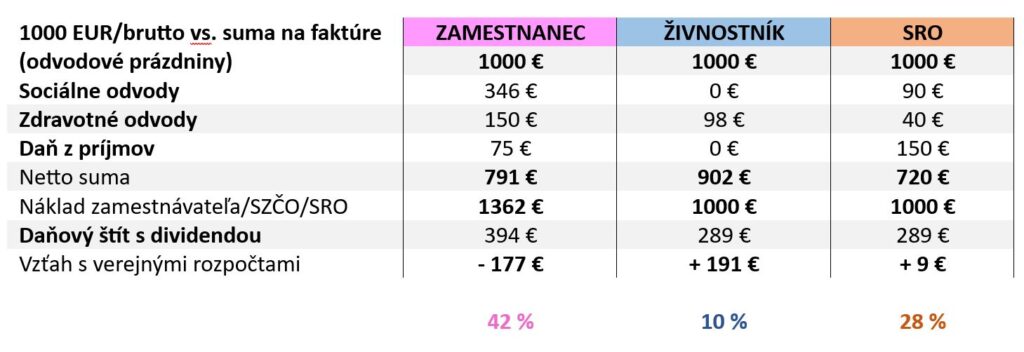

At the conference, we made a detailed comparison of levy rates for different working regimes based on an income of €1,000 gross salary for an employee and €1,000 on an invoice for a sole trader (other alternatives were also discussed).

The results clearly show that the effective tax and deduction rate for an employee is 42%, while a sole trader who uses the deduction holiday pays only a tiny 10%. When compared to a managing director with. r. o. we can see that this scheme is not so advantageous, since with the executive remuneration of the minimum subsistence level, i.e. j. 269 € per month, which is the most efficient in terms of minimum health levies, and we assume that it pays 15% corporation tax, so the effective levy rate is 28%. From the above, we can seem to understand why the incidence of sole traders in Slovakia is so high. To clarify, we provide a brief summary.

Peter Varga at the conference explained in detail the individual items and evaluated the changes in the effective tax-tax rate with increasing wages/remuneration, the obligation of a sole trader to pay social contributions, including the possibilities for SROs to reduce the tax burden through the standard ways in practice for small SROs to optimize (legal/illegal) taxes (e.g. purchase of a car, etc.) and thus reduce the % of the effective tax rate in this table.

You can subscribe to the full video recording of the conference here:

The Shvarcsystem is under the strict supervision of a number of supervisory authorities. The main institutions carrying out controls are:

Each of these authorities has the authority to carry out separate inspection activities, but we know from decision-making practice and findings that inspections are often initiated by the Labour Inspectorate. If it finds a breach of duty and determines that an offence has been committed, it issues a report and informs the Social Insurance Institution.

Employers who violate their obligations face heavy fines not only from the Labour Inspectorate but also from the Social Insurance Institution. The Labour Inspectorate can impose a fine of between EUR 2 000 and EUR 200 000 under the law. The Social Insurance Institution may impose a fine of up to EUR 16 600 and may also impose a penalty of 0.05% for each day of non-payment of insurance premiums, which amounts to 18% per year.

Even a natural person acting as a statutory body can be penalised for illegal work, in which case he or she is liable for the entirety of his or her assets.

The penalties imposed by the tax office are different and this is related to the fact that the tax office has the power to carry out an audit even several periods back, which makes it impossible to determine the maximum amount and could therefore lead to liquidation consequences for the company. During the conference, Peter Varga spoke about the possibilities of how to avoid such liquidating sanctions from the tax office.

The law also defines non-monetary sanctions such as:

Professor of criminal law Tomáš Strémy in a discussion with Petr Varga at the conference also spoke about the criminal aspect of the shvarcsystem. In extreme cases, a prison sentence of up to 12 years can be imposed. More about the criminal aspect of the shvarcsystem can be found in the video from the conference Shvarc system: “Employing freelancers” – where is the line?

Below are some interesting decisions of Slovak and Czech courts on the issue of the shvarc system.

In one decision, the court addressed the question of whether a natural person in the position of a betting shop director may carry out this activity on the basis of a mandate contract or whether it is a disguised employment relationship.

The following facts were found during the inspection. A company operating a network of betting shops employed a betting shop manager under a mandate agreement. The exercise of the activities was varied as it involved setting up a new operation, i.e. providing premises and staffing for a betting office, later on after setting up, he gave reprimands to employees, cut wages, approved leave requests and proposed payment of 13. salaries. He was remunerated monthly for the performance of these activities on the basis of processed attendance.

The subject matter of the mandate agreement is the establishment of a particular business matter, but in this case it was the performance of incidental tasks under the employer’s instructions and orders with an overriding employment character. In its reasoning, the court referred to the standard rule of interpretation of commercial contracts. The basic criterion for evaluating the actual content of the contractual relationship is a proper evaluation of all the circumstances relating to the manifestation of the will of the contracting party, which can be ascertained from the actual conduct. If the parties behave differently from what an ordinary businessman would expect in a mandate contract, then their primary motive was not to enter into a mandate contract and their contractual relationship is simulated. In this case, it was a clear case of legal concealment, in which the court found in favour of the tax administrator.

Another decision concerned a dispute between a taxpayer and a tax administrator concerning the employment of a sole trader as a chief accountant through a mandate agreement.

The tax administrator looked at three main criteria in its assessment: the chief accountant worked at the company’s headquarters, using company equipment (both hardware and software), received a monthly remuneration for his work and, last but not least, the work was a continuous exercise of activity. A mandate agreement is an undertaking by the mandator to establish a particular activity and not an undertaking to perform on a continuing basis, to which the court responded that this strict language interpretation would lead to repeated contracting for each individual matter. If a business matter is defined in a definite way, its implementation may consist in arranging for a single specific matter, and equally in arranging for a recurring activity, or in arranging for a permanent and recurring group of matters. The court further pointed out that the accountant was responsible for the accounts as a sole trader, not as an employee, and it was a secondary activity. Therefore, the court found that this was not a disguised act, but a common phenomenon of the so called. outsourcing, which aims to use external entities for activities that are not the company’s core business and would lead to an unnecessary time and financial burden.

Another decision concerned the employment of tradesmen carrying out construction work for an entrepreneur.

In the present case, the tax administrator did not hesitate to reclassify these activities as a dependent activity. This is because the work was carried out under the instructions of and on behalf of the employer, the builders did not incur any material costs in securing the result, they invoiced only the employer and it was a generic activity. The tax administrator assessed that the above sufficiently meets the definition of dependent work. However, the court stated in its decision that even the totality of all of the above cannot and does not lead to a legal conclusion that the work is dependent work. He went on to say that it is not dependent work if it is specialised work carried out only on a short-term or non-constant basis and where its performance is conditioned by factors largely independent of the employer (e.g. seasonal work, weather-dependent work, etc.). Failure to accept these facts would place an illegitimate burden on the private sphere. On the basis of the above, the competent court disagreed with the findings of the tax authorities and sided with the taxpayer.

In May 2024, the Ministry of Finance of the Slovak Republic published the material “We are looking for a reliable employee. .”[1], in which he states that up to 10% of the offers published on the profesia.sk portal at that time resembled employment in a fictitious trade. These are job offers that give a choice between a trade and a standard full-time job or are directly for a trade, require work on site and are not commercial positions. The areas where the option to ‘work’ as a sole trader appeared most frequently were journalism, printing and media, construction and real estate, marketing, advertising and PR, and telecommunications, for example.

The published material also lists specific advertisements where both a trade or, alternatively, both a trade and a full-time job were listed as “type of employment”. A standard example of such job offers are those in the construction sector, where it is already clear from the advertisement that the work will be carried out according to the employer’s instructions

In law, the principle is that the state of the law must correspond to the state of the facts. Simply put, the contract must reflect the actual situation. You cannot have a contract to do job A if the employee is actually doing job B. This is often referred to as a legal sham. For a better understanding and preparation of employment contracts, here are some of the indicators that should, or should not, be included in contracts. For example, such indicators are:

These indicators can serve as an aid in assessing and proving the true nature of the contractual relationship in a dispute with the tax authorities or the Labour Inspectorate. When setting up relationships for clients, we focus on several details that neither an entrepreneur nor an attorney who does not deal with taxes and levies in detail will notice at first glance. If there is anything you are interested in or would like to assess/set up relationships at your firm, let us know.

The shvarcsystem may seem at first glance to be an attractive employment model, but it hides a number of risks and potential negative consequences. At our conference, we offered an in-depth look at this issue, highlighted the importance of complying with laws and regulations, provided advice on how sanctions can be avoided, and opened a discussion on the opportunities and challenges associated with this model.

If you have any questions or need professional assistance in this area, please do not hesitate to contact us. We are here to help you find the best solutions for your business.

The shvarc system is an illegal form of employment where the employer does not formally employ the employee on the basis of an employment contract, but “hires” them as a sole trader (self-employed) to do the same work as they would do as an employee. In Slovakia, this type of “employment” is not lawful. Of course, not every exercise of a trade or self-employment automatically establishes a schvarc system. Each contractual relationship needs to be assessed individually and therefore, if you have any doubts as to whether your contractual relationship, for example, fulfils the characteristics of a shvarcsystem, please do not hesitate to contact us.

The quack system can essentially be avoided by removing the elements of dependent work and the contractual relationship and transforming it into a legally permissible framework. However, in Slovakia it is still the case that if an employee carries out an activity which has the characteristics of dependent work, this activity must be carried out on the basis of an employment contract.

In the field of employment of freelancers we provide our clients with:

For more information, book a consultation with Peter Varga:

[1] https://www.mfsr.sk/files/sk/financie/hodnota-za-peniaze/analyzy-uhp/fiktivni_zivnostnici_komentar-uhp_maj2024.pdf

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk