Even today, not only large multinational giants such as Google, Facebook or Apple, but also small Slovak companies. These, even to save tens of percent a year in taxes or levies, in a critical number of cases do not need any offshore companies. If you are interested in this topic, feel free to contact us and we will look into your situation.

Tax optimization is still a very lively topic that we encounter in practice almost every day. However, what we always point out in connection with tax optimisation is the very thin and unclear line between legal and illegal tax optimisation. The diversity of economic life as well as the complexity of the legal rules create a space in which it is difficult for a layman to know when he or she is in criminal territory in tax optimisation. That is why it is important that tax optimisation is analysed and possibly proposed not only from a tax and accounting perspective, but also from a legal and practical perspective and ideally under one roof. This is exactly what we offer our clients.

For our clients, we provide a comprehensive analysis of their business in order to set it up to be more tax and levy efficient. That space, in our experience, is critical for the majority of entrepreneurs.

In this context, as the Tax Law Firm of the Year for 2023 and 2024 , we develop high-level and more complex tax law analyses and structures for our clients for the purpose of legal tax optimization of their business. This applies not only to large but also to small Slovak companies In the field of tax optimization we provide for example the following services:

If you are interested in these topics, please feel free to contact us and we will look into your situation.

In its essence, tax optimisation is understood as a procedure not prohibited by law, by which entrepreneurs can minimise their tax burden. In layman’s terms, it is a legal course of action that ultimately results in the business paying less tax. And that is what we strive to do when implementing statutory tax optimization solutions for our clients.

Unlike tax optimisation, which is legal, tax evasion is an illegal or unlawful practice of reducing tax liability. Often times, assessing whether a particular structure is legal or illegal requires a considerable degree of sensitivity and detail, which is what we pride ourselves on, and it is this that guarantees greater certainty for businesses in their tax optimisation. Read Peter Varga’s blog on the KTAG and Andrej Kiska case.

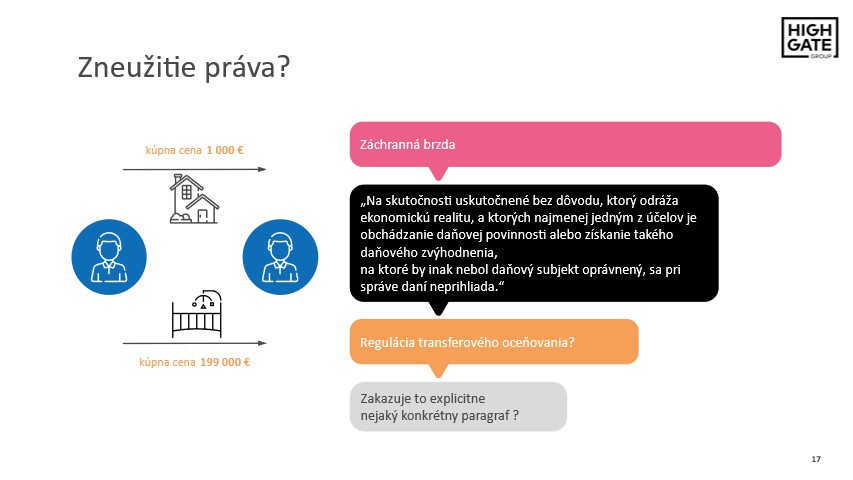

Example 1: A firm makes a profit. However, it does not pay the profit to the shareholder as a dividend, but gives it to the shareholder as a gift and thus avoids dividend tax. The legislation does not formally prohibit such action. We can consider it as:

Example 2: A Slovak living in Slovakia sets up a company in the United Arab Emirates from where he invoices his clients for services. The tax in the UAE can be 0% and this Slovakian associates more than 183 days of the year in Slovakia. Again, no legislation prohibits the establishment and use of this company. So we can consider it as:

This question also raises the process-practice context in which we advise clients, namely, what is the extent of international cooperation in this area? Peter Varga also spoke more about the UAE as well as other countries in his talk on cross-border tax structures at our Crypto conference (read more here). You can view the recording here.

Example 3: An entrepreneur runs a business through his small IT services company. In order to take advantage of the preferential tax regime for sole traders, he sets up a business through which he invoices his company for marketing services. Thus, he shifts the profit from the company to his trade. Assume that the price for services is market-based. So we can consider it as:

Example 4: An IT company has 10 people on its team who work from home or on the premises full time. Of these 10 people, two are in permanent employment and 8 have chosen to work as freelancers in order to have a higher net income. We can consider such optimization as

In April 2024, we held a major conference on the topic of “employing” sole traders and contractors in SROs (more information here). You can view the recording here.

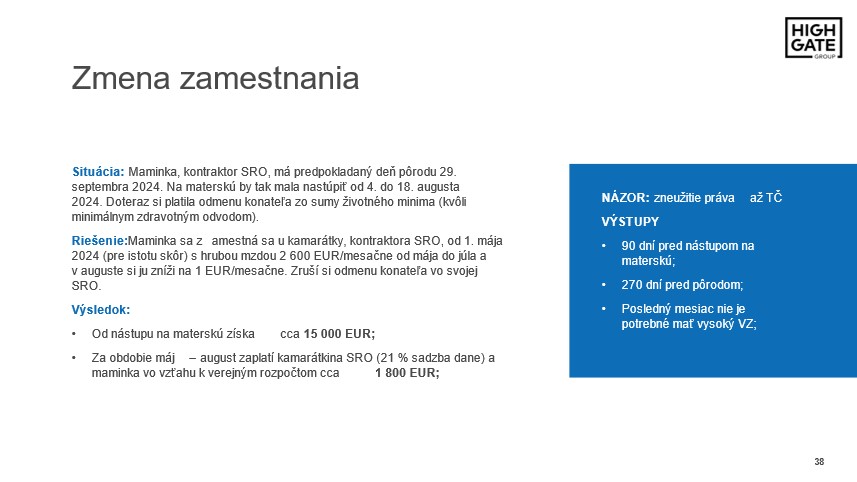

Example 5: A pregnant woman works in the company of a friend. He also owns other companies. In order to increase their maternity leave they agree. that for the last three months he will be employed by his second company, where he will also have a higher salary. Can we consider such a levy optimisation as

Unless the entrepreneur appreciates the already very thin and unclear line between legal optimisation and illegal optimisation, even a tax-optimisation scheme can fall into the realm of criminal law. Thus, if you set up a tax optimisation scheme in the wrong way, you can slip into criminal law, especially in terms of the criminal offence of tax and insurance fraud. There are not many cases in Slovakia that have been analysed in this context of legal and illegal optimisation, even from a theoretical point of view.

This is why it is important not to rely solely on the opinion of a tax advisor when looking for tax optimisation solutions. The legal and constitutional assessment of individual structures does not fall within his remit. Nor is it within his remit to assess under what circumstances it is possible to use a foreign company from, for example, the European Union and thus take advantage of the freedom of establishment. As we deal extensively with these issues within Highgate, we see this as our role not only as a tax adviser but also as a legal and practical adviser on tax optimisation. We also need to talk about theories in law as material correctives that draw boundaries to subjective rights. In fact, quality combined legal and tax advice is not just about the fact that there is a lower tax rate in Hungary or the law does not give a clear answer.

One of the exceptions is the case of Andrej Kiska’s KTAG. The essence of this tax dispute was the inclusion of the costs of the presidential election in the company’s tax expenses. This case is not so interesting in terms of whether the costs in question can be considered as tax expenses.

Its added value lies mainly in the fact that it assesses tax optimisation in this context in a criminal law context. This is a relatively precedent-setting case in Slovak tax law. This case shows us how complex, complicated and unpredictable tax law can be.

While aggressive tax optimization constitutes a tax offence in which the entrepreneur is threatened with a tax penalty and a fine, tax fraud adds a criminal dimension as we have already outlined above. Unfortunately, economic and legal life is so diverse that it is not always possible to assign a place to each economic case in only one of the above sets. And therefore these sets do not intersect at one point = the entrepreneur (and hence his criminal position) is to some extent exposed to the arbitrariness of the decision maker.

Suppose a business wants to take advantage of a lower tax rate in Hungary. He sets up a company there from where he invoices his Slovak company. It shifts profits from a higher tax bracket to a lower one. If an entrepreneur does not want to invest in a relevant advisor, he can make do with the Internet and his Slovak accountant. He finds out on the internet that the Hungarian tax rate is 9% + local tax (2024 figure), finds a company that will set up the Hungarian company and provide him with a registered office, and the Slovak accountant will post the invoices to him. However, if he involves a relevant tax adviser in this structure, he will find that this type of first-order tax optimisation has a broader dimension. For example, the following questions arise:

Counsel brings to the whole context the necessary legal dimension in situations where the written law does not give a clear answer. When interpreting, it uses case law, analysis of various interpretations of law (teleological, grammatical, historical, etc.) as well as philosophy and theory of law, which are necessary to reach in unclear situations. For example, the following topics may be covered:

In addition, you also need to have relevant practical experience with tax optimization .

Especially when using foreign companies, an entrepreneur needs to know in advance what the practice of banks is, for example, to what extent the exchange of information works, or how many administrative and financial pitfalls can be expected (i.e. mandatory audits, AML procedures, onboarding on foreign crypto-exchanges, etc.).

V Highgate Group therefore, we combine all elements into one coherent service. This is the essence of linking law, tax and accounting under one roof. However, our task is also to cultivate the Slovak business environment. Indeed, there are still elements of the early capitalist period, manifested, for example, in a very aggressive perception of the opportunities for tax optimisation. If we are to foster a sense of the rule of law and social responsibility in society, our role as a leader in tax law in Slovakia simply must be to point out the legal limits. Tax optimisation must be legal, based on relevant economic and legal motives and authentic.

The Tax Act The Income Tax Act today contains approximately more than 100,000 words. This is about three times more than in 2004, when the great “Mikloš” tax reform came into force. While the number of words in the law may seem like a meaningless statistic at first glance, the more complicated the income tax law is, the more opportunities for tax optimisation it can provide. And that is why they know how to optimize even “one-person eserocities”.

Just like Google search indexing, tax optimization today must be honest, real, and believable enough to be successful. Even if an agency achieves temporary success by applying a new, unnatural way to improve a website’s search ranking, it’s likely that it’s only temporary and Google will get over it.

The same in taxes. It is not possible to rely on the current practice of financial administration, for example, to analyse more complex operations and structures. Indeed, the limitation period is in some cases as long as 10 years. This also applies to crypto-assets. Society is gradually limiting itself to absolute transparency, and therefore tax optimization today must be built on solid foundations in order to qualify for the set of legal and legitimate tax optimization.

So if this trend of arming the financial administration continues, it may catch up with the taxpayer in a few years.

If you do business across borders, the possibilities for optimisation expand. Never in history has the physical movement of people and goods been as easy as it is today. In the same way, it has never been easier to provide services from one end of the world to a customer located on the other side of the world. In the world, borders are blurring, distances are becoming relative and many business opportunities are becoming more and more real. The open world thus brings opportunities to exploit countries’ tax advantages to optimise taxes, the flow of finance and asset protection.

However, international tax rules and regulation are constantly changing, with increasing globalisation complicating the taxation of both cross-border and domestic operations. Detailed knowledge of this regulation enables us to design and implement efficient and effective tax structures for our clients in cooperation with our foreign partners that meet current regulatory requirements.

If you are interested in this topic, please do not hesitate to contact us:

For more on tax and in particular tax and levy optimisation, see this section of our website: tax and levy optimisation

If you are interested, you can also subscribe to our newsletter about interesting practical legal and tax information free of charge: Subscribe to newsletter.

Alternatively, you can address your specific questions in a consultation with our partner Peter Varga, who specialises in financial regulation and tax law. You can book a consultation here:

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk