Selling a business is a life event for most owners – and often the only such deal in their career. Yet, in Slovakia, we encounter many mistakes that unnecessarily prolong and complicate the sale process and reduce the value of the company. At our Selling and Buying a Business conference, together with a number of experts and experienced entrepreneurs, we openly named the most common problems in the sale process and showed how they can be avoided.

From the first decision to sell a company to the closing of the transaction, it normally takes between 9 and 18 months. In addition to the negotiations and due diligence, there is also a preparatory phase – ideally 1-2 years – to clean up the company, separate non-core assets and set up a suitable structure for the sale. Owners who come to counsel only when an offer is on the table often find themselves under time pressure, which worsens their negotiating position.

The value of the company in the eyes of the owner often differs from the market reality. The subjective view – years of work, investment and personal story – is understandable, but for the buyer it is mainly performance, growth potential and predictability of future results that is decisive. A valuation of the company by an independent valuer prior to the sale will often set realistic expectations and help prepare good arguments in negotiations with the buyer.

“Messy” accounting, unclear ownership of intellectual property rights, scarc-system, missing contracts or unsettled relations with shareholders – all these are common findings during a legal audit (due diligence). Every risk that a buyer discovers has a price: it may mean a reduction in the purchase price, a retention in an escrow account or obligations to indemnify the buyer (so-called indemnity). Preparing a business for sale is therefore an investment that pays for itself many times over in higher value and a smoother transaction.

As with the sale of any thing of value, when selling a business, competitive interest drives up the price. Negotiating with multiple relevant bidders in parallel allows the owner to negotiate better terms – whether it is the amount of the purchase price, the structure of its payment, or the extent of the seller’s liability after the sale. The first offer is rarely the best.

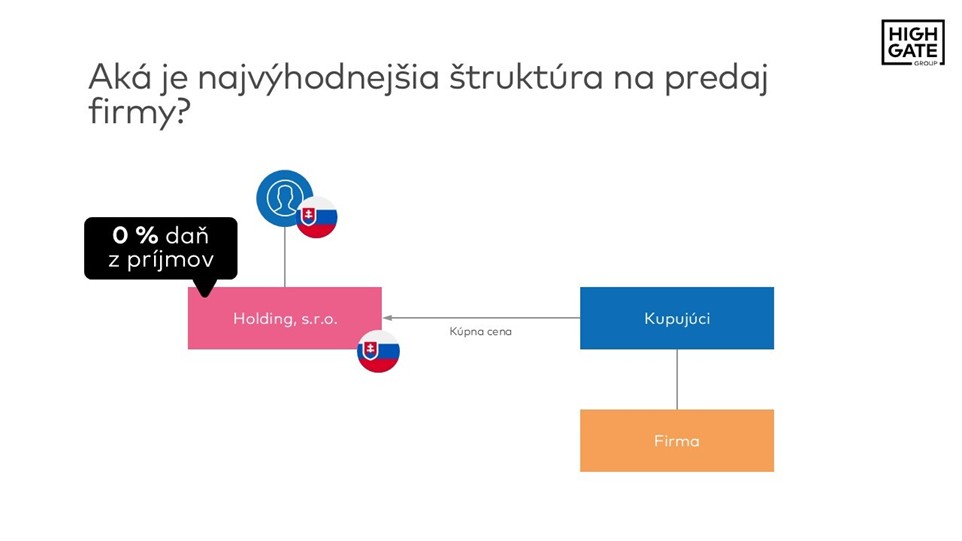

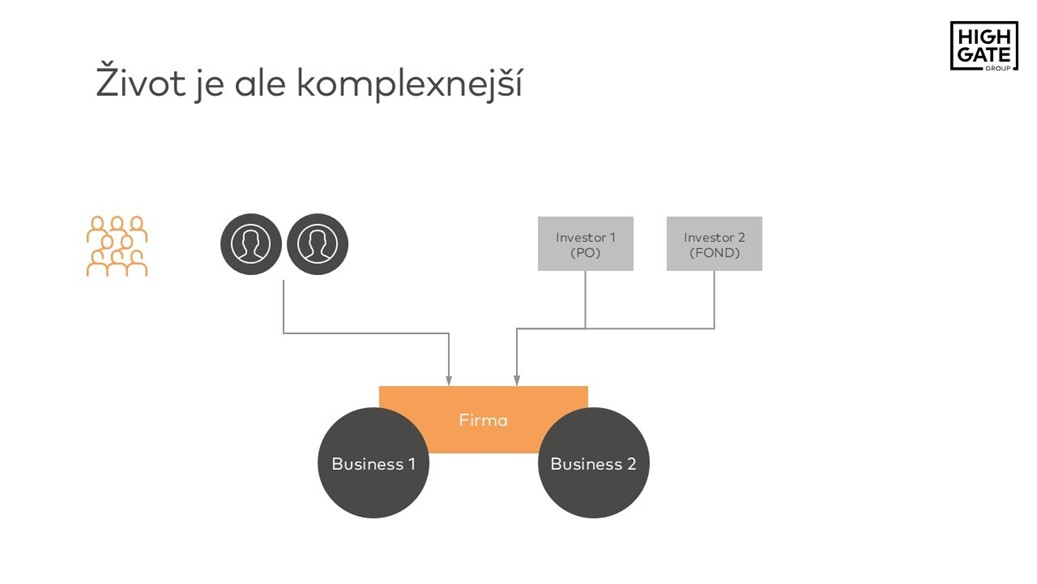

A properly chosen transaction structure (share deal vs. asset deal vs. business deal), a prepared holding and separate “non-core” assets are the basis for a tax and legally efficient sale. Naturally, these issues need to be addressed well in advance – not only when the sale agreement is signed.

Most of today’s transactions include mechanisms whereby a portion of the purchase price is paid only after certain performance targets are met (earn-out) or is held in an escrow account for a period of time as a retainer in the event of claims by the buyer for breach of representations and warranties about the condition of the company. It is important that the seller understands how these mechanisms work in practice, what their risks are and what conditions affect their payout.

Selling a business is not a “side hustle” alongside operations. It requires the full involvement of the owner and key management people who know the details of the business and can answer questions from investors or advisors. Keeping the sale secret from management can ultimately slow or jeopardize the entire process.

Selling a company is a complex project where business, law, tax and psychology meet. The best results are achieved by owners who prepare early, have realistic expectations, work with multiple interested parties and have an experienced advisor by their side from the start.

More information about the conference, speakers and a recording of the event can be found here.

Watch a short aftermovie from the conference here.

We are Highgate Group – modern advisors for your law, tax and accounting under one roof.

Subscribe to our newsletter for more expert tips and business news.

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk