As the topic of tax optimization is the Highgate Group’s domain, in addition to his own conferences and workshops, Peter Varga also participates in various lectures for professional organizations. This was also the case with Peter Varga’s recent lecture for Eseminare on tax optimisation, which took place in November 2023.

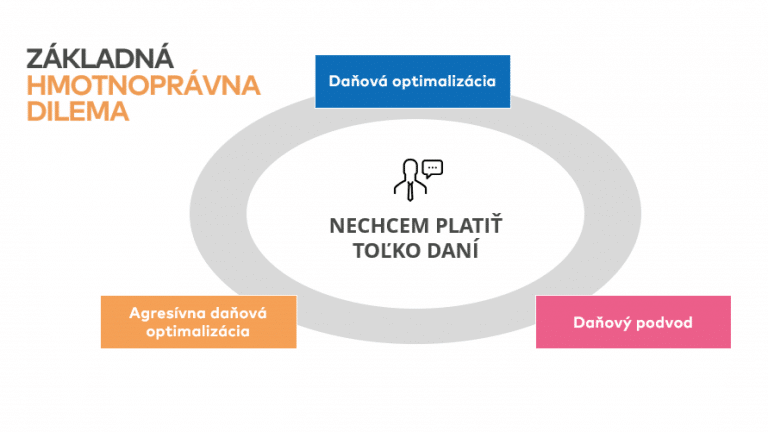

Tax optimisation is a mythical topic. However, when discussing it and its eventual practical implementation, it is important to bear in mind the legal limits within which it must operate. It is not possible to set up a company in Hungary and benefit from lower taxation without there being some non-tax reason for doing so, and at the same time there is no relevant justification for the transfer of profits to Hungary itself. Otherwise (especially in the case of some fictitious invoices), this may even amount to the criminal offence of tax and insurance fraud.

In fact, in some tax-optimisation schemes, the taxpayer may cross the line and get into the criminal arena. Also to avoid such risks, it is important to set up any tax optimisation and related schemes with legal aspects in mind and not to be satisfied with tax advice alone.

In fact, in some tax-optimisation schemes, the taxpayer may cross the line and get into the criminal arena. Also to avoid such risks, it is important to set up any tax optimisation and related schemes with legal aspects in mind and not to be satisfied with tax advice alone.

We have also covered the topic of tax optimisation in our online training courses, which are available here:

It is still a phenomenon in business practice to use company money or other assets for private purposes…

The spinning of non-DPA companies may also have criminal implications..

In tax practice, there are a number of situations where it is important to have a rational justification for an action in order to defend a particular tax position. Often there is talk about the so-called. main purpose. Otherwise, the tax administrator may treat the transaction or act as a special purpose t. j. abuse of the law and taxpayer to be taxed.

However, there are situations where the main purpose may be to obtain a tax advantage (e.g. to favour a trade over an SRO), but this is not an abuse of the law because the step does not contradict the purpose of the law.

If you are interested in the topic of aggressive tax optimization, we recommend you to read the interesting cases we have dealt with in this regard:

Determine whether a particular tax optimization is legal or can be sanctioned…

In lectures and meetings with clients, we often mention a type of tax optimization that, while not illegal, is also not legal. Simply put,…

In addition to these topics, Peter Varga’s lecture focused on various legal and legitimate tax and legal technicalities that normally lead to a reduction of the tax and/or levy burden. We have also organized several conferences on this topic, we give presentations at various forums and write professional articles.

A recording of our conference on tax optimisation can be found here:

A recording of an 80-minute presentation from our conference on legal and tax optimization for technology companies, which we organized…

If you are interested in this topic, please do not hesitate to contact us.

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk