On October 24, 2024, we organized the Radisson Blu Carlton Hotel Conference on cryptoassetswhich brought together more than 160 participants from various sectors – entrepreneurs, advisors, government representatives, as well as investors and crypto-asset enthusiasts themselves. This conference created a unique space to discuss regulatory challenges, tax and legal aspects, as well as technical and investment issues that are key to the cryptoasset business today.

Attendees had the opportunity to learn about the latest developments in cryptoasset regulation, and to get answers directly from experts to questions about optimal practices for taxing, accounting for or structuring their cryptoasset business. At the same time, we have not bypassed topics such as tokenization of financial instruments or raising capital for projects involving cryptoassets.

For those who did not have the opportunity to attend the conference, this article provides a brief overview of the various topics that were covered at the conference. At the same time, if you are interested in a recording of the whole conference, or just a part of it, we have video recordings of the conference available for you, which you can find at this link.

The conference opened with a lecture by Petr Varga and Roman Baranec, who focused on the use of various regulated infrastructures in the field of cryptoassets, as well as their legal, tax and accounting aspects. They addressed, among other things, the current legislation governing cryptoassets, the different types of cryptoassets as defined by the MiCA Regulation, cryptocurrencies, tokenized financial instruments, and the various tax and accounting challenges posed by cryptoassets. Together with Martin Bittar from Okazio, they then presented the company’s new ESOP product, which in many aspects interferes with the regulation of cryptoassets.

The topic was followed by Peter Pénzeš from the National Bank of Slovakia (“NBS“), who discussed the licensing procedure for the provision of cryptoasset services and stressed the importance of pre-licensing consultations with the NBS, which allow cryptoasset service providers to better prepare their business plan for the requirements of the licensing procedure. Participants thus had the opportunity to learn that, in order to demonstrate compliance with the conditions for the licensing of cryptoasset service providers, the respective applicants will have to thoroughly prepare themselves not only to comply with the requirements set out in the MiCA Regulation, but also with a range of other relevant legislation, such as AML regulations, digital operational resilience, consumer protection, as well as with the so-called TFR Regulation on data accompanying transfers of funds and certain cryptoassets.

This part of the programme thus provided participants with essential information on the requirements that cryptoasset service providers will need to meet, while also highlighting the importance of the licensing process, which aims to eliminate illegal and unethical practices in the market. The stringent requirements imposed by the regulation of cryptoassets will result in only licensed entities capable of complying with these requirements being able to provide cryptoasset services, which should also significantly increase the level of investor protection.

After Peter Pénzeš’s lecture, we continued with a panel consisting of Juraj Forgács, co-founder and CEO of Fumbi, Radim Kozub, attorney at law and partner of the Czech law firm Blockchain Legal, and finally our partner Peter Varga. The panelists looked at the new legislation regarding the provision of cryptoasset services from a practical point of view, for example, what the MiCA Regulation will bring for current market participants, how much the licensing process will cost and how much the new requirements will increase the operating costs for cryptoasset service providers. They also looked at how the situation in this area compares to the Czech market.

After the lunch break, the panel was renewed, and the current challenges that the new regulation of cryptoassets brings for companies operating in the financial sector were discussed by Ivana Senderáková from Tatra Banka, Daniel Gašpar from Crowdberry, Ivan Melay from Salmann Investment Management AG, and their discussion was moderated by our partner Peter Varga. This panel brought a lot of interesting insights and inspiring thoughts on the following topics, among others:

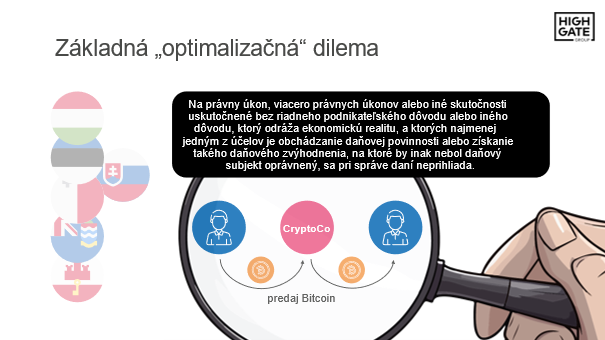

The next item on the conference agenda was a lecture by Peter Varga on tax aspects of cryptoassets. Peter talked about the basic optimization options to reduce tax liability for cryptoassets, whether it is so easy to set up a company abroad and use it for tax optimization purposes and which countries may be preferred for this purpose, as well as how complicated it is to change tax residency. He also explained, using a concrete example, how complicated it can be to assess whether tax optimisation is legal or already illegal.

The lecture by Petr Varga was followed by a panel discussion led by our partner Tomáš Demo, where Andrej Coplák from Blockmate, Boris Suchovský from NBS and our colleague Vladimír Gaduš discussed. Together they discussed the risks of money laundering in cryptoasset trading, financial fraud with cryptoassets, and the misuse of cryptoassets for other illegal activities. They also addressed what resources the NBS has to crack down on cryptocurrency fraud, and the challenges that cryptocurrency service providers will have to deal with under the KYC/AML processes to succeed in licensing proceedings before the NBS.

In the last panel of the conference, we focused on doing business with cryptoassets in various foreign jurisdictions. The panelists were Miroslav Makovini from Incorporatas for the United Arab Emirates, Peter Howitt from Ramparts for Gibraltar, Petros Rialas from Totalserve for Cyprus and Michal Hanych from smpl_ for the Czech Republic. Their discussion was moderated by Peter Varga. Together, they discussed the advantages of each jurisdiction, giving the conference participants an overview of the conditions for doing business in cryptoassets in those jurisdictions and, of course, their tax and legal specifics. The discussion also provided an opportunity to compare the costs of setting up a company in each country, as well as the operating costs required to run such a company. This international panel provided useful advice for those looking for alternatives to the domestic market and new ways to optimise their costs and increase their competitiveness in a global environment.

Apart from the individual panels and lectures, we could also listen to interesting individualkeynote speeches by our guests who have been working in the financial sector or in the field of cryptoassets for a long time. Cryptoassets as an investment asset in mutual funds was discussed by Michal Májek, a member of the Board of Tatra Asset Management, Juraj Forgács also spoke on the question of whether cryptoassets can be considered a relevant institutional investment alternative for retail and finally the cryptoasset platform Millionero was presented by its CEO Suleman Kazim.

Our thanks go not only to all the speakers and panelists, but also to all the participants who contributed to the success of this conference with their active participation. We believe that the conference provided all attendees with valuable information, room for discussion and a new perspective on the many challenges that the new regulation of the cryptoassets market brings.

If you are interested in this topic, please do not hesitate to contact us:

For more on the legal, tax and accounting regulation of cryptoassets, see this section of our website: crypto and legal and tax structures

If you are interested, you can also subscribe to our newsletter about interesting practical legal and tax information free of charge: subscribe to newsletter

Alternatively, you can address your specific questions in a consultation with our partner Peter Varga, who specializes in financial regulation (including cryptoassets) and tax law. You can book a consultation here:

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk