Choosing between an external accounting firm and an in-house employee is a key decision for any entrepreneur. From cost savings, to access to specialist knowledge, to minimising the risks associated with errors, an external accounting firm brings a number of benefits. Read on to find out why working with outside experts may be the right choice for your business.

In the beginning of a business, it is usually started “on the knee”, with the main goal being to make the business survive the turbulent start. However, invariably the business gets to the point that administration becomes more complicated, there is less time for the business itself and the need for keeping various records arises.

Established companies regularly undergo structural changes for a variety of reasons. One example is the company’s increased growth, to which processes have to adapt. Another example might be unexpected personnel changes that trigger a merry-go-round search for a relevant replacement.

In both cases, whether a start-up or an established company on the market, management should ask itself elementary questions about its future. If this train of thought is narrowed down to the accounting and administration of internal processes, questions arise as to whether to create in-house positions or to use the services of an external company.

There are many factors that should enter into the decision and it is not possible to divide all accounting units into imaginary categories based on the amount of turnover or the number of employees and determine the intervals until which it is rational to employ an accountant, at what interval accounting should be outsourced and from what point the company should think about setting up an internal economic department.

Accounting entity – a company that decides over an internal or external solution

Service organisation – external accounting (advisory) company, acting as a supplier to the entity

Internal accountant – an employee of an entity who is responsible for the accounting agenda

An external accounting firm or an internal employee in the economic department? Both options have their own characteristics, from which positives and negatives can be deduced. Just as each accounting entity is unique, service organisations have different focus, composition and mentality, and therefore the comparison is not made in a unified way, but is based on experience in the Slovak environment.

Depending on the size of the company and the business model, it is crucial whether a single accountant is sufficient or whether a small team or an entire department covering all economic processes needs to be created. For this reason, some points will apply more and others less to these alternatives.

In the following sections, the main differences are presented.

In other words, staff turnover is expressed as a percentage and is based on the ratio of terminations to the average number of employees over a certain period. The natural turnover rate depends on many factors such as business sector, unemployment rate or seasonality. An unnatural turnover rate (also called unavoidable turnover) is an undesirable phenomenon. In order to retain employees, it is necessary to devote considerable time and attention to them. This is primarily true for the more skilled workforce. Ideally, the following prerequisites should be met:

Internal accountant

– Great effort and time dedicated to keeping turnover rates low.

External accounting firm

+ Turnover within the service organization only causes a change in the assigned accountant, which does not impact bookkeeping or communication.

Turnover is related to the replacement of departing employees, the complexity of which is determined by the position or unemployment rate in the region. In November 2024, the share of available jobseekers in Slovakia reached an all-time low of 3.73%, according to information from the Slovak Labour, Social Affairs and Family Office. In the search for a suitable replacement, a great deal of time is spent sorting through the applicants and only then do selection interviews take place, which often lead nowhere and in the end, as is the custom in Slovakia, the ‘least evil’ is chosen.

Internal accountant

– Recruitment is difficult, requiring intensive involvement of management, an HR employee or a “headhunter”, which is an additional administrative or opportunity cost.

External accounting firm

+ The selection of a service organization consists of a phone call, or a personal meeting and e-mail communication in which the details of cooperation are agreed.

+ The process does not have to be repeated in the long term if satisfied.

Accounting is an unregulated profession, so it can be practised by a person who has no professional knowledge. In Slovakia, membership of a professional chamber is not compulsory, as for example for tax advisors or auditors. At the same time, in the context of frequent legislative changes, an accountant should regularly follow the approved amendments or participate in seminars and trainings conducted by tax advisors or representatives of the Ministry of Finance of the Slovak Republic.

Internal accountant

– Often he or she does not have the opportunity to consult an experienced colleague or tax advisor.

– An employer who does not have a basic understanding of accounting cannot reliably assess a candidate’s qualifications during the selection process.

External accounting firm

+ Have internal training on legislative changes.

+ The team consists of a number of accounting, legal and tax experts who have dealt with a wide range of accounting and tax cases.

+ Advise tax advisors on specific tax cases.

+ Multiple checks by more experienced team members.

The company may require the prospective employee to perform work at the company’s headquarters to be available to them when needed. In the digital age, this element drops out of the list of necessary requirements, as the option of remote working is also offered. Service organisations are often required to have a workstation in the same location as the entity’s head office so that they can be available at short notice if needed or can bring physical documents to them for processing the monthly accounts. Digitisation in service organisations allows simplification of the circulation of accounting documents and the absence of paper documents.

Internal accountant

+ Accountants are available to the employer during working hours.

– Possibility to look for employees only from the vicinity of the headquarters and not from all over Slovakia if they do not allow remote work.

External accounting firm

– They are available to the client at a lower intensity than staff.

+ They are available to the client online/in person if needed.

+ They can process accounting of clients from all over Slovakia or abroad.

The more specific the accounting cases in an entity, the more difficult it is to find accountants or service organisations that can reliably account for these cases, with an emphasis on their tax implications, and, in the case of a large number of such cases, import them in a time-efficient manner. A good example is the trading of financial instruments in a brokerage account or crypto-assets in a trading asset. If the engagement with the previous accountant or service organization is terminated, finding an adequate replacement can be difficult because the pool of qualified replacements is very narrow, which goes hand in hand with a higher cost of work or price of services.

Internal accountant

– Individuals in the labour market largely lack specific skills.

External accounting firm

+ Service organisations that provide specific services find it easier to find replacements after an employee leaves, and the dedicated team providing those services remains functional.

Accountants and payroll accountants have monthly and annual peak workloads. Outside of this season, there may be downtime, particularly for internal staff. Consultancies are known for frequent overtime during peak season, but there is still plenty to work on outside of peak season, as the client portfolio is diverse and the accountant is able to organise their work in a logical way to spread their efforts and meet all statutory and client-agreed deadlines.

Service organisations have the ability to allocate their workforce of accountants efficiently. At the same time, during the holiday period, team members take leave on different dates so that someone is always available to the client. Internal employees without a team do not have the opportunity to take holidays during the season and if they cover the complete agenda including payroll, they can only use the holiday period after filing the VAT return until the beginning of the following month, when they have to process the employees’ payroll, not to mention the various statistical and other reports, the deadlines for which are different.

Internal accountant

+ In the off-season, a greater amount of leave may be taken or an additional economic agenda may be delegated.

– The risk of being incapacitated during the season without a substitute is borne by the company.

– In the event of sick leave or vacation, he/she shall not be available to the employer without relevant substitution.

External accounting firm

+ In case of temporary absence of the assigned accountant, the service organization shall appoint a substitute colleague.

Service organisations cover the accounting for a larger number of clients. For this reason, they can benefit from multiple economies of scale. This includes the administrative costs of running the company or the software. In the case of an in-house position, it is essential to ensure the functionality of accounting programs, various subscription or cloud services.

Software equipment:

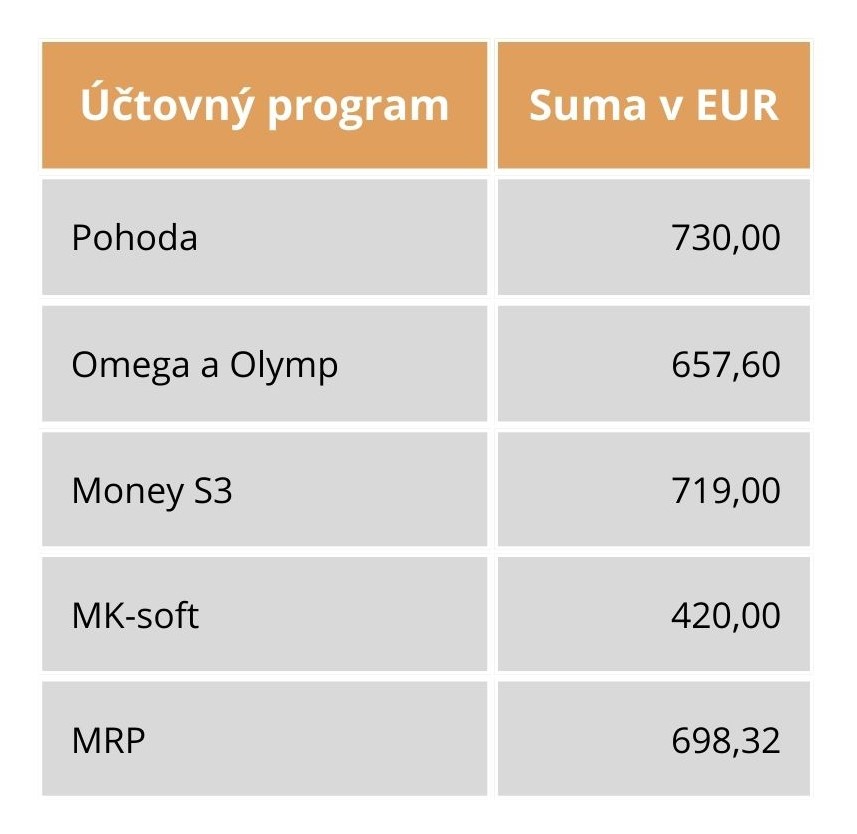

The basic tool of every accountant is an accounting program. In Slovakia, the most commonly used are Pohoda, Omega, Money, MK-soft, MRP and others. The price for each program varies and it is impossible to compare them without knowing the needs and size of the accounting unit. In addition to the basic accounting programs, accounting units also use a separate program or platform for issuing invoices to customers. With the advent of artificial intelligence, the possibilities of processing accounting documents have expanded and platforms have emerged that offer a service to extract data from documents, which helps accountants with increasing efficiency.

With electronic accounting, there is a need to store more data, and cloud storage must be adapted to this. Together with Microsoft Office licences, which undoubtedly help accountants in their work, and IT management services, they represent another area of cost. Even for a small company, software equipment can run into hundreds of euros a year.

Subscriptions:

The service organization uses subscriptions to various training, associations and utilities. The published prices as at 3 December 2024, excluding VAT, for annual subscriptions to the most commonly used platforms are shown in the table below:

These subscriptions are not compulsory for every accountant, but they enhance the skills of accountants, help them to work with specific cases and help them to prepare for upcoming legislative changes.

Internal accountant

– Most of the costs associated with accounting are not fully recoverable or recurring.

External accounting firm

+ Costs for accounting programs, subscriptions to professional literature, training and much more are not borne by the client in the price of the service.

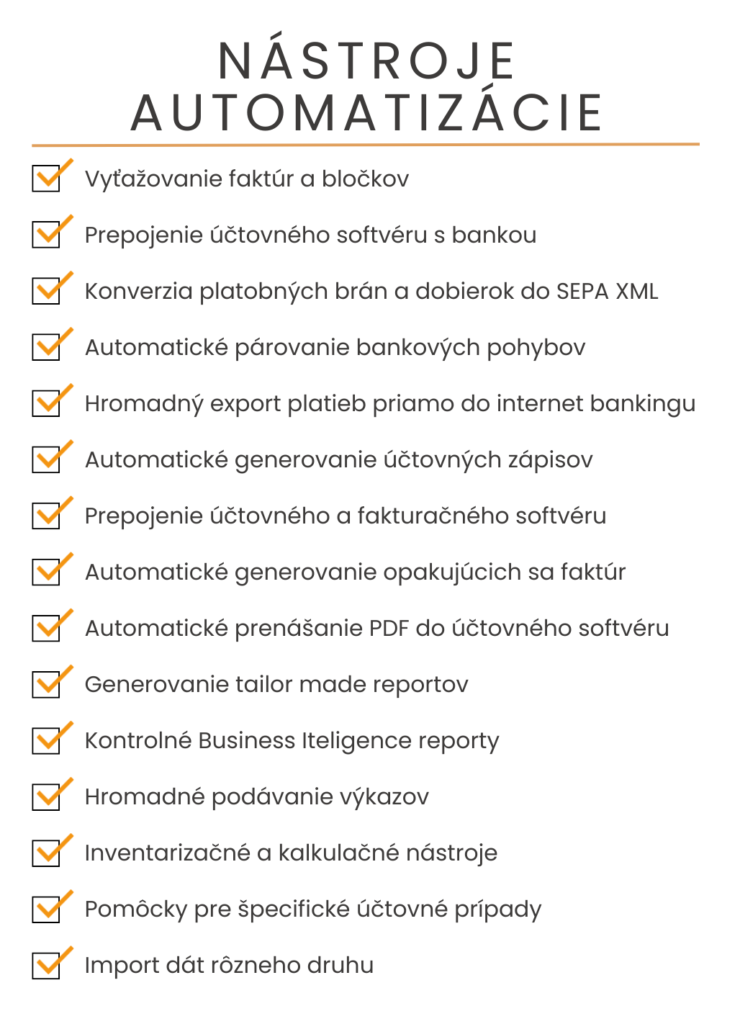

Practical activities that are repetitive, time-consuming and predominantly ‘manual’ in nature are the subject of efforts to eliminate them. Service organisations are making great efforts to simplify or streamline such activities in order to reduce the need for less skilled labour and to relieve clients of the administrative burden. The automation and digitisation of accounting is made up of many elements, with even a large number of smaller improvements that work together harmoniously and complement each other having a significant impact on improving efficiency.

Internal accountant

– They may not have the capacity and experience to streamline accounting and administrative processes.

– The streamlining benefit can be applied to only one entity or a small group of entities.

External accounting firm

+ Regularly apply automated processes to practice.

+ For a large number of clients with the same problem, one automated process can be used multiple times.

+ Service organizations have the know-how and can help the client in setting up processes.

Various errors may occur when processing accounting documents and uploading submissions to the Tax Administration website, which may result in penalties or interest on late payments. Any larger service organisation should be insured against any damage caused to clients. Law firms are required to have insurance, which is not the case for accounting firms. Therefore, when selecting a contractor, it is necessary to check that they are properly insured. For the benefit of mutual trust, it is customary that penalties resulting from errors made by a service organisation’s employee are not borne by the client but paid directly by the service organisation.

In the event of an employee’s error, the terms of the wage deduction can be modified in the employment contract, but the law sets a maximum amount that the employer can deduct from the employee’s wages.

Internal accountant

– Limited ability to obtain compensation for damages.

External accounting firm

+ They should be insured against any damage they cause to clients.

+ Have internal control mechanisms set up.

+ Their accounting treatment may have been audited for larger or specific clients, which creates a presumption of correctness for other entities as well.

The service organization’s accountants have set standards and the same procedure is followed in the event of a change in the assigned accountant. When an internal employee changes, continuity may be disrupted because each accountant has different habits related to bookkeeping. This may not apply solely to accounting, but also to the storage of documents in electronic folders or physical filing cabinets.

Internal accountant

– Changing accountants without handing over the agenda can lead to accounting errors or loss of documents.

External accounting firm

+ They have set internal rules that aim at a uniform procedure for all clients.

– If the service organisation changes during the accounting period, a duplicate accounting cost may be incurred if a review of the accounting records taken over or a reconstruction of the accounting records is necessary.

Accounting is a necessary evil for small business owners. That is why the main parameter is the price they have to pay for accounting. Service organizations are primarily guided by a responsibly prepared price list when agreeing with a client. In addition to salary and remuneration, in-house employees also need essential working resources such as computer, mobile and various software. At the same time, unless they work exclusively remotely, their employer must provide them with an office space. Last but not least, they may incur training costs that are not reflected in the service organisation’s prices.

To show the possible costs of accounting, it is necessary to take into account the specificities of the entity. The scope, business model or complexity of operations also determine the resulting cost. Specific accounting cases can include:

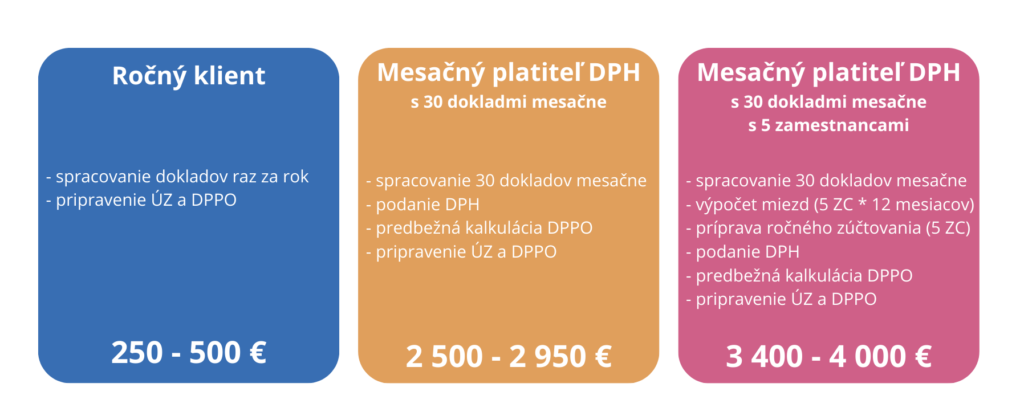

Abstracting from these cases, which are less common in statistical entities, we can outline three theoretical possibilities for comparing the cost of bookkeeping. The amounts are shown net of VAT because VAT payers can deduct the tax from their liability and non-tax payers can invoice services from a non-tax payer company.

Annual client:

It is sufficient for such a client to keep accounts on an annual basis, as it is not registered for VAT, has no reporting obligations, has no employees and no specific accounting cases. Once the documents have been processed once a year, the financial statements are prepared and the corporation tax return is prepared. The amount of the accounting costs in this case is between EUR 250,- and EUR 500,- per year, depending on the volume of documents.

Monthly VAT payer with 30 documents per month:

On average, 30 documents are processed per month, on the basis of which a monthly tax return, control statement or summary value added tax statement is prepared. Before the end of the year, a provisional income tax calculation is prepared. After the year-end, the accounts and the corporation tax return are prepared. The approximate amount for accounting services may be between EUR 2 500,- and EUR 2 950,- per year.

Monthly VAT payer with 30 documents per month and five employees:

Compared to the previous option, you need to add the cost of payroll accounting for five employees, which includes registering and deregistering employees with the tax office, health and social insurance, monthly payroll calculation, preparation of the annual settlement and many other steps. If we count five employees who have been registered in the past and no changes have occurred during the year, and the annual tax settlement is made after the end of the tax period, the amount for payroll accounting can amount to between EUR 900,- and EUR 1 100,- per year. Together with the amounts for monthly accounting, the cost to the entity would be approximately EUR 3 400 to 4 000 per year.

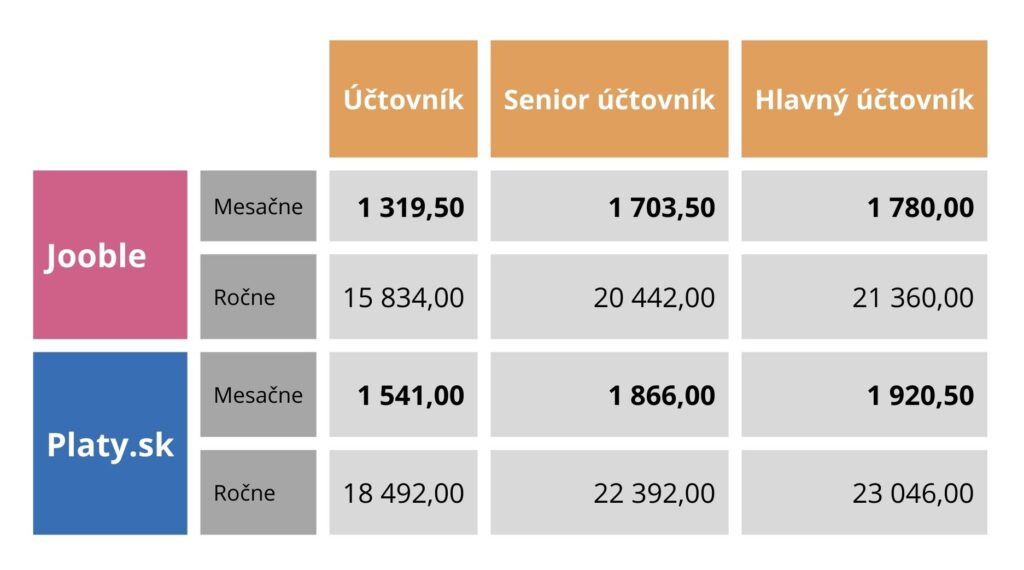

Wage costs of an internal employee:

Based on the data published by Platy.sk and Jooble, it is possible to divide the positions of accountants into three levels:

There is no precise definition and job description for these positions, but if it is a classic limited company, without specific accounting cases, candidates for all positions should be able to cover the accounting agenda.

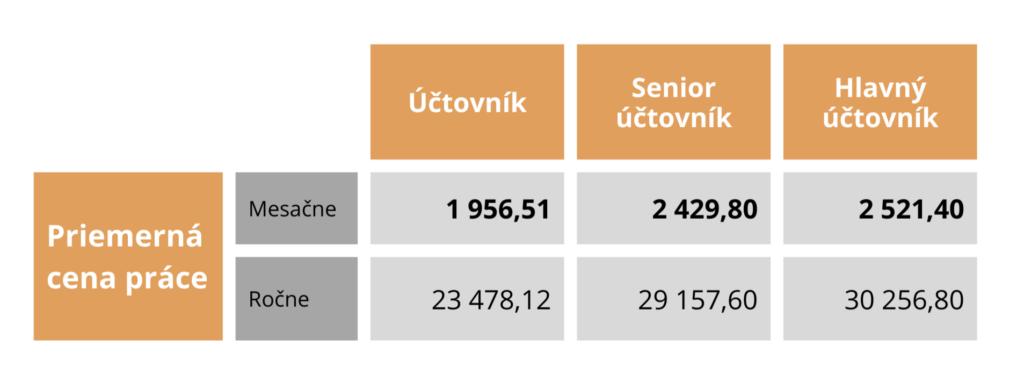

The following table shows the gross salary of employees in each position and is based on the median of job offers as of 18 December 2024. The amounts are in euros.

However, what is relevant for the entity is the cost of the work, which includes, in addition to gross wages, the levies that the employer is legally required to pay. If we calculate the average between Jooble and Platy.sk and add the employer’s levies, the labour cost of each position is as follows.

Comparison:

The figures show that it does not make sense for small entities to employ a full-time accountant. The alternative is part-time employment or the use of an independent external accountant, which entails certain risks. If such a person does the internal bookkeeping and is not employed by the company, the company unnecessarily exposes itself to the risk of penalties under the ‘ shvarc system’ (’employment of freelancers’). We have talked more about this phenomenon at our conference or in our articles, videos and interviews. In some cases, the “employment of freelancers” can also bring the entrepreneur into the criminal arena.

Internal accountant

– Hardware and software costs.

– Cost of training, office space or meals.

External accounting firm

+ The price for accounting and related services is predictable based on the price list and contract.

+ The service organization may provide various benefits and discounts.

The following chart summarizes all the positives and negatives of the internal staff and the service organization for comparison.

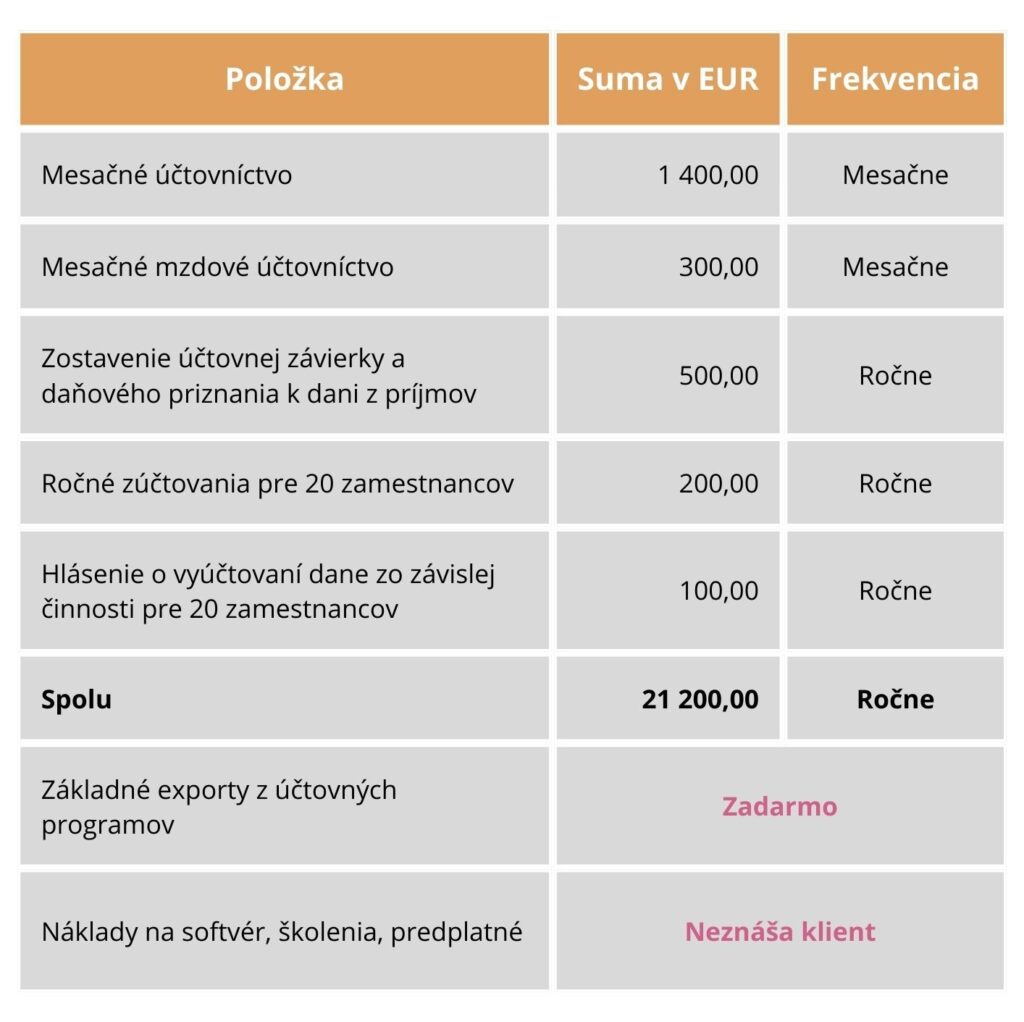

Imagine a Slovak limited liability company that provides IT services to customers. This company is subject to value added tax according to § 4 [1]. It records 500 documents per month and has 20 employees throughout the year. There are no specific accounting cases.

The assigned accountant processes monthly documents (on average 500 documents per month) and posts bank statements. He/she informs the client about missing documents, evaluates outstanding payables and calculates the preliminary monthly VAT amount. After client reconciliation, submits the tax return, the control statement and, if necessary, the summary statement to the tax administration.

Before the end of the year, he prepares an inventory of accounts and a preliminary tax calculation for the client to know which documents are missing, what areas need attention and what the anticipated corporate income tax liability is.

After the year-end, in cooperation with the client, he closes open items, prepares the final tax calculation and, after reconciliation, prepares the corporate income tax return and financial statements, which are checked by the chief accountant and then filed with the tax authorities.

The assigned payroll accountant will process monthly payroll for 20 employees, file monthly statements and reports, and handle communication with the health and social insurance company and the tax office.

At the end of the year, it prepares an annual tax return and a tax return for all employees.

What would be the price for accounting services?

The prices below are an estimate of the current prices for accounting services on the Slovak market. The service organization will inquire about other facts that may help in automating and importing accounting entries, which may also result in a lower price for monthly accounting services when creating a quote. Some service organisations offer their services cheaper, which mostly indicates that they use less qualified staff or students for the current agenda or they process accounting for a large number of clients, the accountants are overloaded and the risk of incorrect, incomplete and inadequate accounting increases.

Superior advice is usually charged in accordance with the applicable price list and in this case we assume that the entity has set up processes and therefore does not need any advisory services such as more extensive statutory tax optimisation.

First of all, it is necessary to identify what level of knowledge the internal accountant of such a company should have. At the same time, not all accountants can fully cover the payroll agenda. In this case, we can say that there should be such a senior accountant on the market who should be able to handle the job.

The average annual cost of the work of such a senior accountant is € 29 157,60 per year without remuneration, based on the tables above.

To this amount we have to add the cost of the accounting software licence. We have compared the prices of the licences recommended by the accounting software providers themselves for the entity on the accounting software providers’ websites and configured the necessary functions. The prices for the annual subscription are shown in the table below.

Assuming that it is an IT company, we can abstract from the cost of IT the management of the software and hardware necessary for bookkeeping, which is carried out by the company in-house. In this way, the accounting entity saves hundreds of euros per year compared to the situation if they had contracted an external supplier. It should be added that the regular updating and maintenance of accounting software is specific and therefore the employee in charge should have adequate experience.

The IT company has some economies of scale with Microsoft licenses and a computer for the accountant anyway, so we don’t need to take these costs into account either. For other types of accounting entities, they would be guaranteed to increase the cost of an in-house employee.

In the case of an in-house accountant, the knowledge he can provide to the employer will be included in the price of the work. If non-standard accounting or tax cases arise which the employee will not be able to cover competently, the cost of external advice will be incurred. In order to maintain qualifications, the accountant must regularly attend training courses and further education to prepare for legislative changes.

The accounting costs for a service organisation would be at the level of € 21 200,- per year. The cost of an in-house employee with the cheapest accounting software and the provision of software and hardware in-house would be € 29 577,60 per year. In the context of the previous parts of the article, we can say that an in-house employee brings additional disadvantages such as substitutability, a more difficult selection process, potentially less automation, more difficult substitutability and replaceability or others.

In our experience, we see that larger clients need administrative staff to take care of the document cycle and communication with accountants. Nevertheless, there is a money saving compared to employing several accountants. Some of the points that have been a negative of having in-house staff are partially offset if it is a larger team or an entire economics department. This is mostly the case in large and multinational companies, but even in them it happens that they delegate some parts of the agenda to a service organization. In practice, we have seen a model in which internal employees cover the normal workload and the service organisation covers more sophisticated tasks, such as payroll, various taxes (value added tax, income tax or motor vehicle tax), preparation of financial statements or controlling.

An alternative to a service organisation may be an accountant who acts as a contractor to the entity and provides accounting services to a larger number of clients. Thus, it is an individual who provides accounting services to clients alone. In this case, however, there are a greater number of risks associated with qualification, error or substitutability. In any case, we recommend signing a service contract with the accountant or service organisation.

Each company is specific and therefore the assessment of each point must be based on individual needs. In any case, the correct choice of a service organisation eliminates possible negative effects on the company’s operation and its finances, as incorrect accounting can result in penalties, for example from the Tax Authority, but also criminal consequences for the statutory officers.

Should you decide to opt for a service organization, we bring to your attention our next article available at the following link:

https://highgate.sk/5-dovodov-pre-prenechanie-vedenia-vasho-uctovnictva-highgate-group/

If you are interested in this topic, please do not hesitate to contact us:

For more in the field of accounting, see this section on our website: digitisation of accounting.

If you are interested, you can also subscribe to our newsletter about interesting practical legal and tax information free of charge: Subscribe to newsletter.

Alternatively, you can address your specific questions in a consultation with our partner Peter Varga, who specializes in tax, legal tax optimization and setting up business structures. You can book a consultation here:

[1] Act No. 222/2004 Coll. on value added tax

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk