The issue of the so-called “shvarc system” (i.e. the “employment” of freelancers/contractors) is a topic that has been a part of the Slovak business environment for decades. The main motive for the preference of contractors over employees is the obvious tax advantages. On the other hand, such an arrangement brings several challenges.

These are mainly legal-regulatory challenges:

At the same time, it is certainly advisable to know the threshold beyond which such a possible illegal arrangement may have criminal consequences.

Naturally, the Schwarz system also brings economic challenges. The micro-economic ones involve a whole range of tax-tax linkages and comparisons between trades, copyright contracts, employment or SROs. This is not only in the context of the effective tax-tax rate, but also in the context of the obligation to pay health/social insurance premiums as well as social insurance benefits. For example, it is not impossible that for an individual of a certain age and with a certain work history, it is more advantageous to remain in an employment relationship as opposed to a trade, because the ‘delta’ of the amount of savings in a trade is not higher than the ‘delta’ of the amount of a higher pension at a certain life expectancy. Among the macroeconomic challenges, for example, an interesting one is that of tax optimisation, which speaks of its positive effect in terms of putting pressure on the state to manage more rationally.

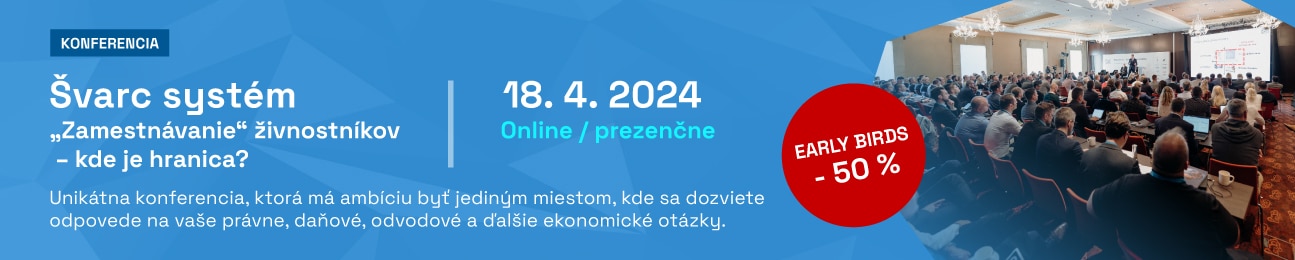

Whatever. This conference aspires to be the only place that wants to answer all relevant legal, tax, levy and other economic contexts. We will be happy to see you there. Take advantage of the unique opportunity to attend the conference conveniently online or physically with limited seating.

Prof. JUDr. Tomáš Strémy, PhD. works as a criminal lawyer and scientist, holding the post of professor at the Faculty of Law of Comenius University in Bratislava and at the Police Academy of the Slovak Republic. Since 2006 he has been a university lecturer. In 2010, he received an honorary mention for his long-term active cooperation with the Institute for Criminology and Social Prevention in Prague for his significant contribution to the development of criminology. At the Ministry of Justice of the Slovak Republic, he served as a member of the Commission for Substantive Criminal Law (2012 - 2014), a member of the Commission for Streamlining the Use of Alternative Sentences and Electronic Monitoring in the Slovak Republic. He participated in the development of the Law on Criminal Liability of Legal Persons. He lectures for the Judicial Academy of the Slovak Republic, was a member of the commission for the selection of the European prosecutor (2018 - 2019), a member of the commission for the mass selection of judges and currently holds the post of presiding judge at the Supreme Administrative Court of the Slovak Republic. In the Slovak Bar Association he is a member of the working group for criminal law. He is a researcher and co-investigator of several grant schemes, author or co-author of more than 260 publications (monographs, textbooks, professional articles) and actively participates in scientific events at home and abroad.

in

Martin Vlachynský joined INESS as a new member in 2012 after previous cooperation. He graduated from the Faculty of Economics and Administration at the Masaryk University in Brno, and subsequently completed a master's degree at the University of Aberdeen. He is interested in economic policy, business environment and competitiveness, especially in the healthcare and energy sectors. His regular projects include the Bureaucracy Index and the Health for Money Index.

in

Katarína Matulníková is the managing partner of the Bratislava office of Wolf Theiss, where she leads the employment team. With more than twenty years of experience in employment law, she regularly advises large multinational and national companies from various industries on a wide range of employment law matters. Her experience includes advising on the formation of employment relationships, secondments, assignments and transfers of employees, employment restructuring and redundancies. In addition to drafting standard employment law documentation (employment contracts, agreements, internal regulations), Katarina has extensive experience in structuring relationships with statutory bodies and top management, various benefit and incentive schemes. She is an enthusiastic supporter of speak-up culture and whistleblowing and is a sought-after legal advisor to employers in conducting internal company investigations and reviewing whistleblowing allegations and notifications. She regularly represents clients in collective bargaining, individual employment, and collective bargaining disputes. In addition to employment law, Katarina has valuable experience in commercial law, corporate law and real estate transfers. Katarína is the Chair of the Labour and Social Affairs Committee of the American Chamber of Commerce in Slovakia and a member of the European Employment Lawyers Association.

in

Peter Varga is a partner at HIGHGATE Group, where he focuses on tax and tax advisory services in addition to capital markets law. In connection with tax and levy advisory Peter helps clients to set up remuneration structures, including the modification of contracts in order to eliminate legal and tax risks related to the optimization of tax and levy costs. Peter regularly lectures and writes articles on tax optimization, including the topic of the shvarc system.

inMiesto: Styles Event Hall

Speaker: Peter Varga (Highgate Group)

Speaker: Peter Varga (Highgate Group)

Speaker: Peter Varga (Highgate Group), Katarína Matulníková (Wolf Theiss Bratislava)

ATTENDANCE

The participant receives a checklist of the essentials for the correct setup of contracts with contractors

Participants can interact directly with experts during the conference and outside the official programme

Attendees can ask questions directly to the presenters during the conference or via Slido

Networking

Refreshments during breaks and lunch together

Limited number of tickets

ONLINE PARTICIPATION

The participant receives a checklist of the essentials for the correct setup of contracts with contractors

Participant can ask questions to presenters via Slido

Online access to lectures throughout the day

Highgate Law & Tax s. r. o., Nivy Tower, Mlynské Nivy 5, 821 09 Bratislava, ID No.: 51 477 262; will rely on its legitimate interest under Article 6(1)(f) of the GDPR to make photo and video documentation of interesting moments of the conference and its participants, which may subsequently be used for the purposes of marketing activities and promotion of the company.

Although the production of the above documentation is not subject to the consent of the participant, we respect your possible disinterest in having your person photographed. In this case, please inform one of our hostesses during registration or send us your request to info@highgate.sk.

For more information about the processing of your personal data, please visit the Personal Data Processing Notice section of our website.