Crypt taxation and the related tax optimization are one of the most attractive topics we encounter in our daily practice. The ever-growing interest of our clients in dealing with crypt tax issues has motivated us to create a platform where this issue is discussed openly, professionally and practically. That is why we organized a unique Crypt Conference, where we addressed this burning topic and the recording of which can be found at this link.

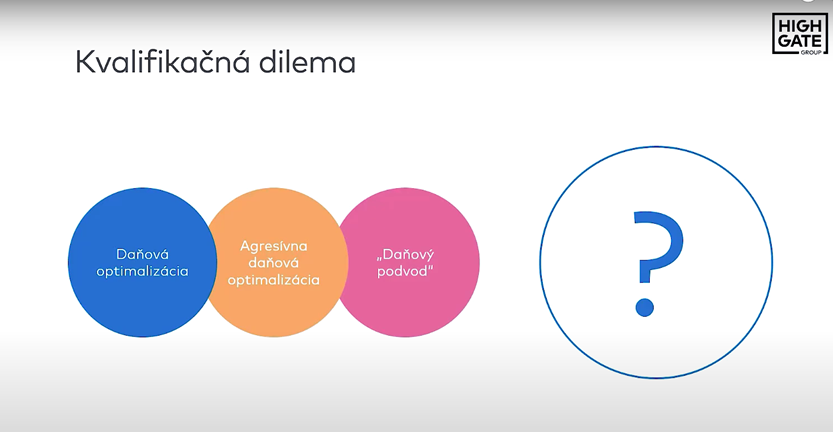

In today’s article, we’ll give you a glimpse into the key points discussed at the conference and bring you up to speed on the most important insights into cryptos’ taxation and legal tax optimization options. What people often forget is that tax optimization always involves some degree of discomfort, change, or deviation from what the legislature expects you to do. However, with the right approach, you can achieve significant savings on your tax burden, all within the applicable legal frameworks.

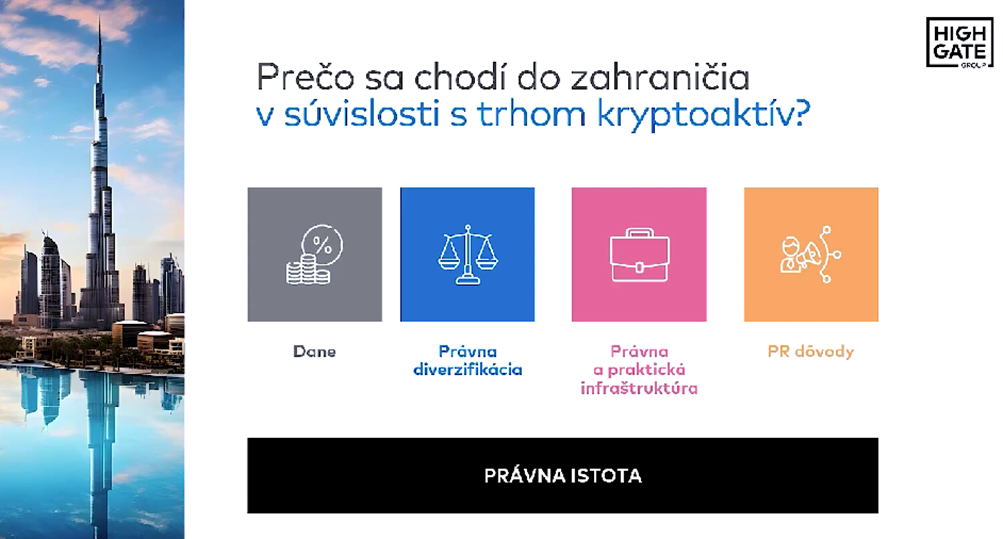

One of the most common reasons why people move their activities or headquarters abroad is taxes. It is tempting to consider countries with favourable tax rates, such as Cyprus, Malta or Dubai. But the tax benefit alone is often not enough to make such a move produce the desired results. Without careful planning and consideration of other circumstances, a move abroad can be not only ineffective but also counterproductive.

In addition to taxes, other factors need to be taken into account:

The question remains, however, to what extent these reasons are legitimate and whether they actually outweigh the tax aspects. This is where our role as experts comes in. Our aim is not simply to tell you that there is 0% tax in Cyprus, but to help you set up a comprehensive structure that is not only efficient, but above all legal and practically feasible.

Moving abroad is a serious decision that requires not only knowledge of the tax laws but also an understanding of the wider context and implications. And that’s where we see our added value – to help you create a solution that both works and complies with the law.

Businesses today often face the complex issue of tax optimization in cryptos. A typical example is an individual who owns a cryptoasset such as Bitcoin. Before deciding to sell, he or she often discovers that he or she is subject to a 25% + 15% tax in Slovakia. At the same time, he registers that from 2025 the corporate income tax is reduced to 10%. The natural tendency, therefore, is to invest Bitcoin in the company. Is it really that easy? The answer is no. Other questions arise. At what price should a given cryptocurrency be put into a company, i.e., how should it be valued?

The law does not impose an obligation on individuals to deposit Bitcoin in a company and to value it at fair value, and the CFC rules also do not apply to non-business individuals. This means that at the end of the day, Bitcoin can be on a company’s balance sheet without breaking the law. But with such a strategy, we run up against metaprinciples and the material concept of the rule of law. After all, subjective law is not absolute – and even in such an action, there may be a misuse of tax law.

If an entrepreneur does not set up the structure correctly and encounters an abuse of rights problem, even though his or her actions are not expressly prohibited by law, he or she may face serious consequences. The tax administrator may assess such conduct as an abuse of the law if there is a lack of clear rationalisation and professional set-up. In such a case, it would view the transaction of the sale of Bitcoin by a legal entity as if it were made by an individual and tax it in accordance with the rules for individuals.

Each such optimisation step requires an individual approach and careful thought, as the wrong decision can have far-reaching consequences, even in the criminal sphere. With us, clients find comprehensive advice in the areas of tax, law and accounting. Our strengths lie in our attention to detail, precision and professional approach. We focus on ensuring that our clients not only have the right structures in place, but also the confidence that all of their actions are defensible and compliant with the law.

This topic is also covered in the webinar Practical tips on how to legally optimize taxes when selling a crypt.

If you are interested in this topic, please do not hesitate to contact us:

For more on tax and in particular tax and levy optimisation, see this section of our website: tax and levy optimisation

If you are interested, you can also subscribe to our newsletter about interesting practical legal and tax information free of charge: Subscribe to newsletter.

Alternatively, you can address your specific questions in a consultation with our partner Peter Varga, who specialises in financial regulation and tax law. You can book a consultation here:

You can also find out more interesting information in our Highgate Talks video podcasts.

Law & Tax

Tomas Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk